How to Improve Elliott Wave Analysis

Use It with Balance of Power as a Combination Indicator

Improve your Elliott Wave Analysis and Trading System with a few simple additions to your Technical Analysis. Increase profitability, simplify the process, and make the analysis easier and more reliable. This will save time and improve the use and analysis of Elliott Wave for all Trading Styles.

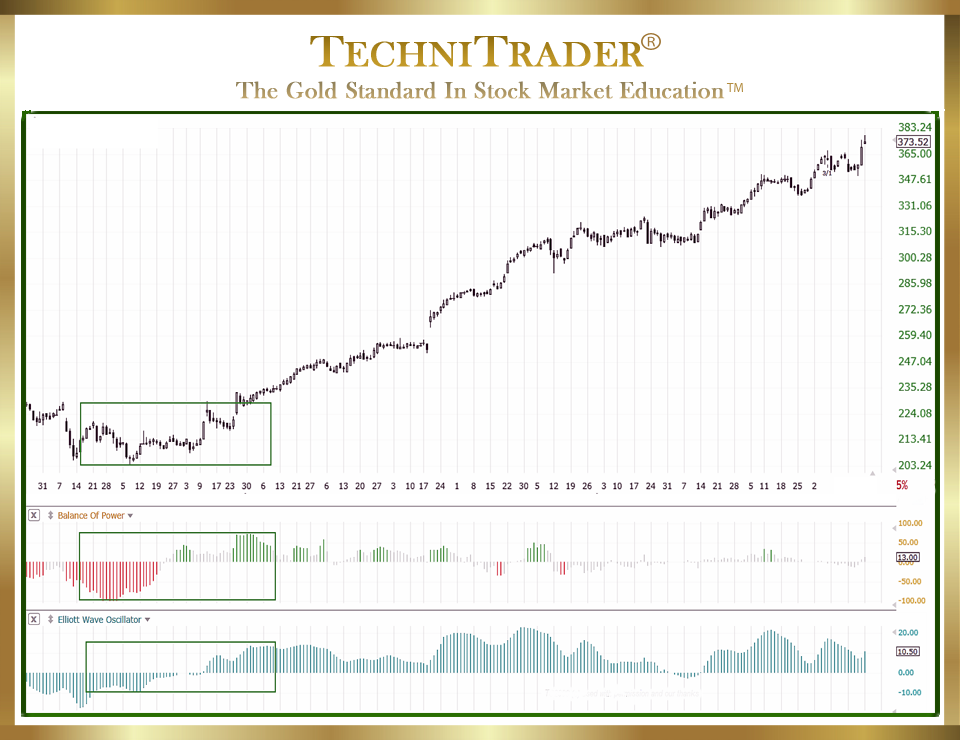

The chart example below from TC2000 is set up with a Combination Indicator called Balance of Power (BOP) that shows the wave formation in an easy-to-see graphical representation. Balance of Power also reveals which of the Stock Market Participant Groups created that wave. This is vital information because it can help you see what type of wave is likely to form next. It explains deviations in wave patterns and helps you avoid weaker entries and poor-quality trades.

TC2000 is one of the rare charting software that includes Elliott Wave as an indicator which can be used in a variety of ways to make trading the Elliott Wave Strategy easier and less work.

The first step in making your Elliott Wave Strategy or System work better is to understand what is creating the Elliott Wave Patterns. This analysis goes beyond the standard and traditional Elliott Wave Theory to learn WHY the patterns form. When you understand the why of a theory, you are able to interpret the wave patterns with far more accuracy. When you understand who is creating which waves, you have a powerful analytical tool that will reduce risk and increase accuracy and thus profits.

The internal Market Structure has changed enormously in the past few years. Dark Pools using Alternative Trading System (ATS) venues account for nearly 40% of all trading activity each day, but this data is not shown on the exchanges. High Frequency Traders (HFTs) front-run pre-market Retail Trader orders.

Professional Traders employ new professional exclusive orders, routing, and analysis that does control price to the penny.

What this all means is that the Retail Trader needs something, such as a tool or method, to track the hidden inner market where the majority of trades are occurring.

Unfortunately for most Retail Traders and Technical Traders, all of this change is hidden and unknown. The advantage you have is that TC2000 has indicators which provide information that will forever change how you use the Elliott Wave Theory or Trading System.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a TC2000 chart, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.