How to Trade Stocks Profitably for Beginners

Precise Sideways Price Action Means Buyers Are Dominant

Most Individual Investors and Retail Traders do not realize that they have a huge advantage over the professional side of the market. This is due to the constraints, restrictions, rules, and regulations the professional side must comply with on an ongoing basis. It is also due to the fact that 80% of the Professional Traders still do not use Technical Analysis.

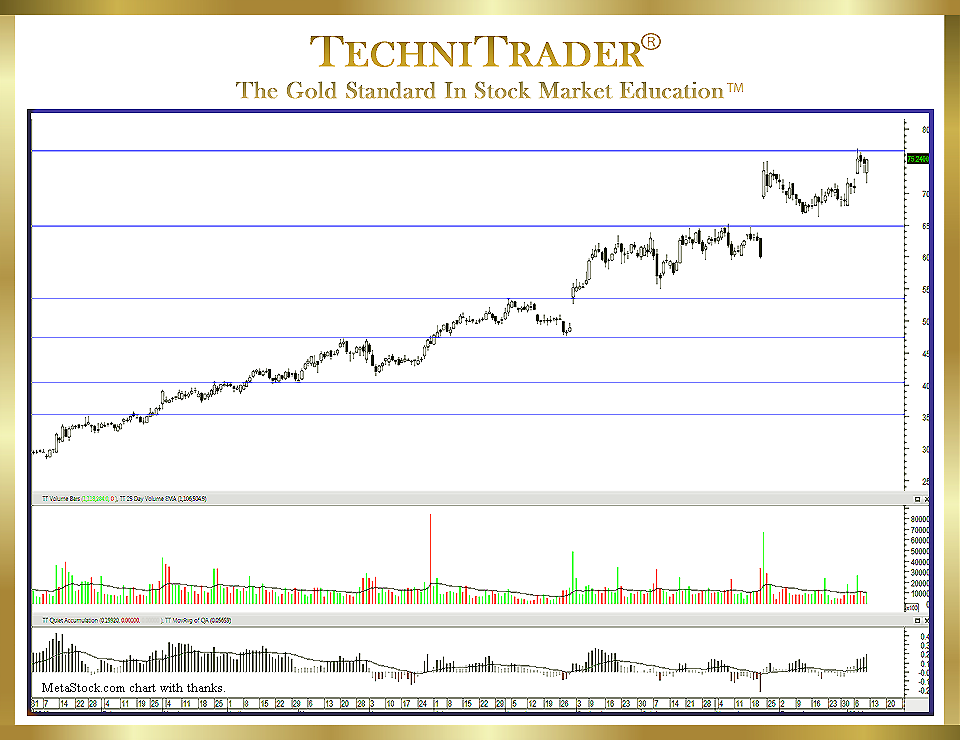

In the candlestick chart example below, it is very obvious immediately how precise and consistent the sideways candlestick pattern is over time. What is also noticeable are the gaps that follow the sideways candlestick pattern.

Sideways price action that is precise like this means that the buyers are dominant. They have a huge amount of capital reserves and buy with a controlled and bracketed order that contains price within a narrow range and eliminates momentum action and volatility. There is also an incremental candlestick pattern in the sideways action. Each sideways candlestick pattern prior to the gap or run up is nearly equal in time duration.

These are the candlestick patterns that giant Buy Side Institutions create when they use Dark Pool Alternative Trading Systems (ATSs), consequently building platforms as they slowly accumulate millions of shares of stock. The more Giant Funds that buy the stock, the more consistent the platform candlestick patterns will be. The giant Buy Side Institutions are buying in incrementally over time and controlling price during their accumulation phase.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a MetaStock chart, courtesy of Innovative Market Analysis, LLC dba MetaStock

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.