What Are 5 Sell Short Tips During a Market Correction?

Recognizing Platform Candlestick Patterns™

There have been many changes to the technical patterns of the downside in recent years. Knowing what to study in technical patterns to improve profits is necessary in order to successfully Sell Short stocks during a Market Correction.

Here are 5 Sell Short tips for stocks during an Intermediate-Term Market Correction or a Bear Market:

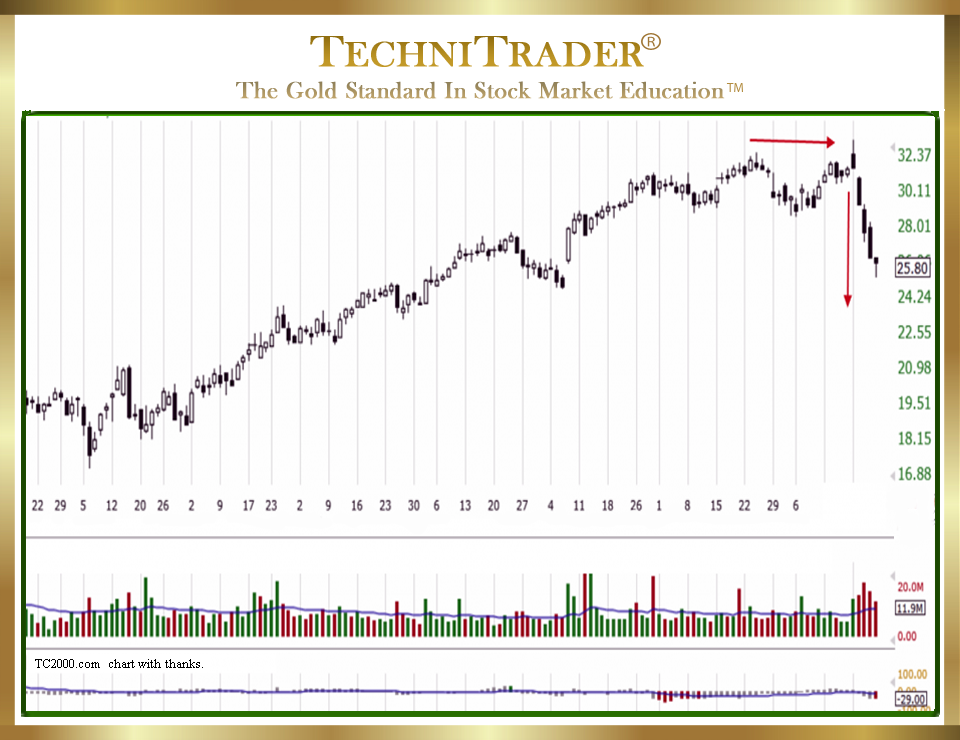

1. New Topping Candlestick Patterns

The older textbooks on Technical Analysis feature 5 main Topping Candlestick Patterns. However, due to the giant Buy Side Institutions moving their huge-lot orders off the exchanges into Dark Pools and the numerous new stock order types available to them, Dark Pool Quiet Rotation™, which is the method of slowly lowering their quantity of held shares, is now changing the structure of tops.

Candlestick chart example #1

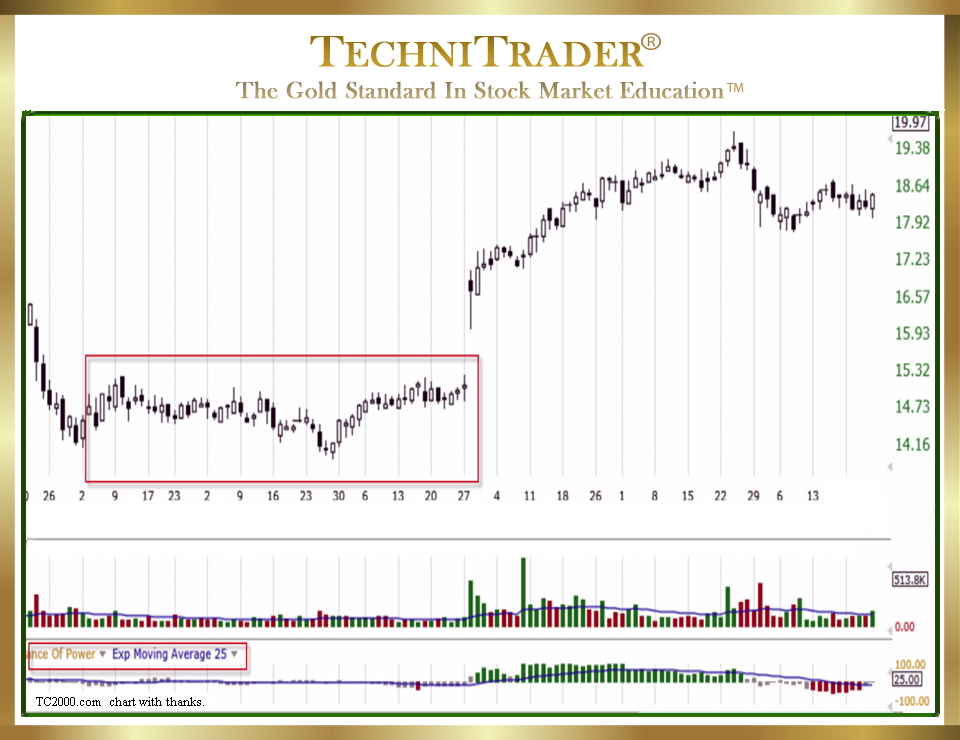

2. New Bottoming Candlestick Patterns

Part of learning to Sell Short stocks is to know when stocks will reverse and move up. Bottoming Patterns during a Market Correction are also different than the primary bottoms that most traders have learned. This example is to show that it is important to recognize when a stock is poised to move up instead of down. The key factor again is identifying the most important Stock Market Participant Group, which is the giant Buy Side Institutions. They have the ability to control price during their Dark Pool Quiet Accumulation phase. Their stock order type does not trigger their incremental buying unless the stock is within a certain price range called a Dark Pool Buy Zone™ because they use a bracketed order.

Candlestick chart example #2

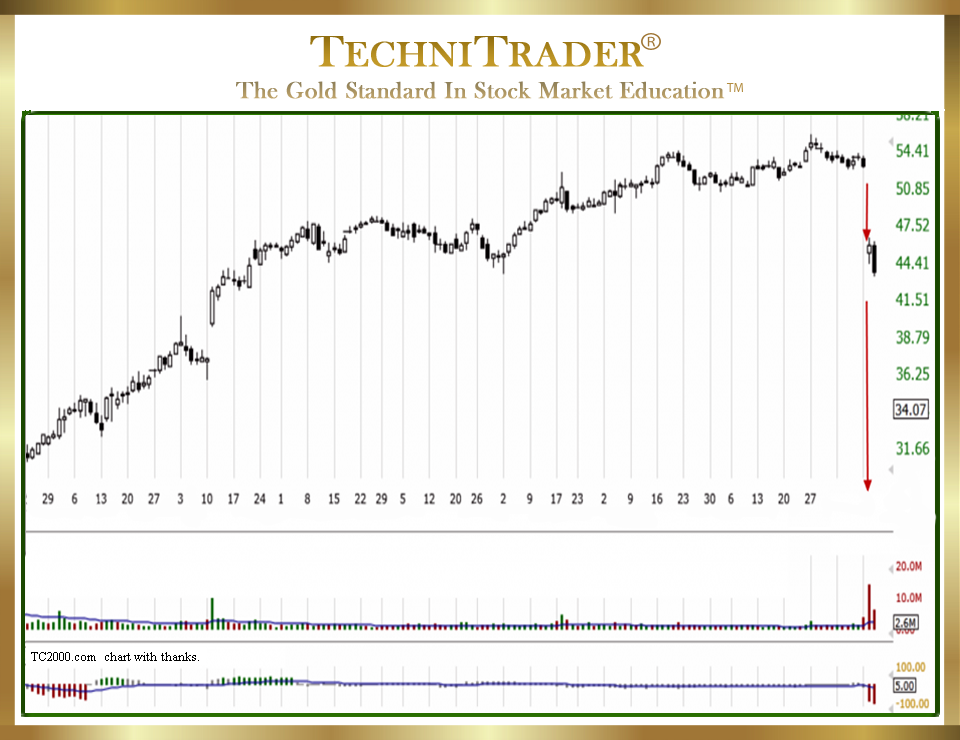

3. High Frequency Traders (HFTs)

Sell Short tips for stocks include recognizing that High Frequency Traders have also created new Topping Candlestick Patterns and often create huge gaps that are much larger than in prior decades before High Frequency Traders existed. The automated millisecond orders of the High Frequency Traders create huge price runs that normally last for one day. Swing, Momentum, and Day Traders need to be in the stock prior to these big gaps and runs on very high stock volume in order to enjoy the big gains.

Candlestick chart example #3

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using TC2000 charts, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.