How to Interpret Bollinger Bands® Direction of Breakout

Dramatically Improve Interpretation with Simple Techniques

Trading with Bollinger Bands is easily enhanced with a few simple techniques you can start using right away. The first step is proper interpretation of Bollinger Bands for stock trading. There are Bollinger Bands trading signals you can learn by simply adding another indicator with Bollinger Bands to give you a complete data set for your stock pick analysis.

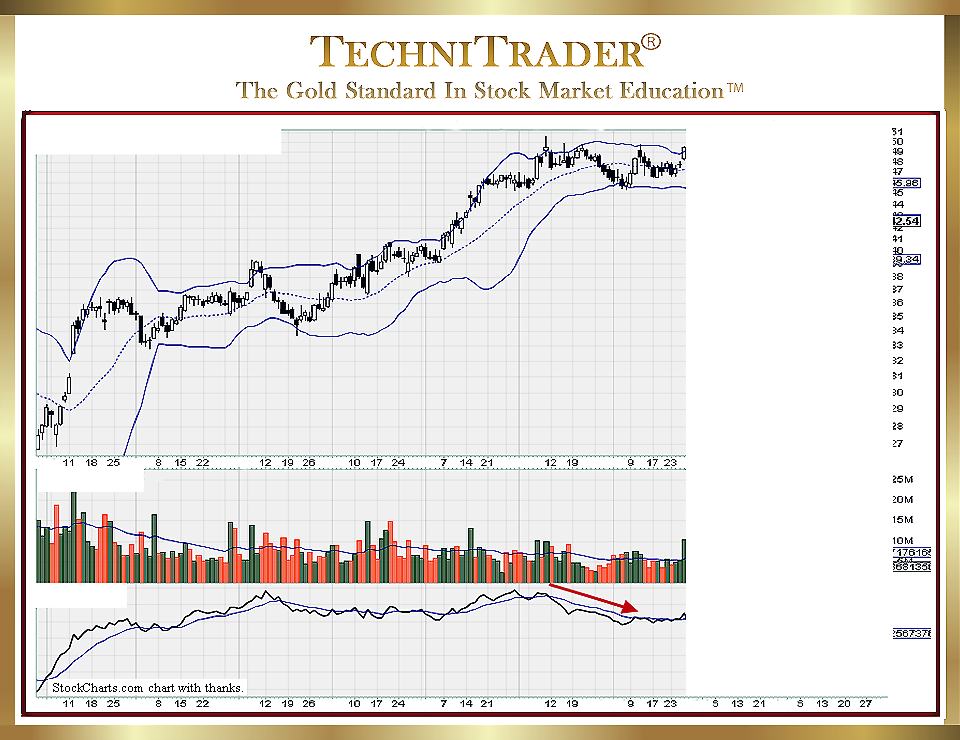

Below is a candlestick chart example of a Bollinger Bands compression pattern. Just using the bands and candlesticks or even other Price and Time Indicators, the assumption could be that the breakout will be to the upside. Buying the stock with the assumption of an upside breakout is a common mistake of traders using Bollinger Bands.

The red arrow shows how the large-lot versus small-lot StockCharts.com indicator called the “Accum/Dist indicator” has dropped below its signal line even before the stock breaks out. Even though a white candlestick formed a common gap, the indicators show that large lots are selling while smaller lots are buying. Whatever side of the transaction is dominated by larger lots, that is the direction the stock will take.

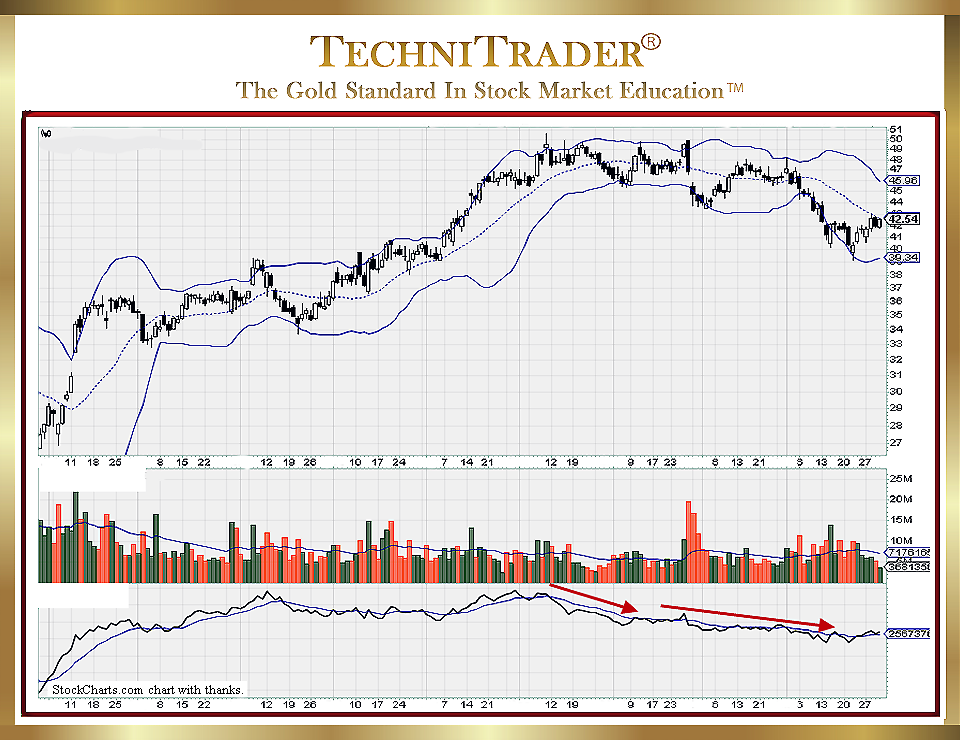

The stock chart below shows what happened after the common gap. A bearish signal pointed to a Flat Top Candlestick Formation followed by a selling down of the stock. The compression pattern on Bollinger Bands broke to the downside.

Bollinger Bands help you to see compression candlestick patterns prior to sudden breakouts, which lead to stock prices moving with momentum or velocity. However, Bollinger Bands cannot tell you the direction of the breakout without additional information. All you need to do is learn how to use essential indicators with Bollinger Bands to dramatically improve your interpretation.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using StockCharts charts, courtesy of StockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.