What Is the Market Update for Swing Trading and Day Trading?

They Are Affected by Changes to High Frequency Trading Regulations

The Securities and Exchange Commission (SEC) is considering a Test Pilot Program to initiate a study to determine if the High Frequency Trading “Maker-Taker” role is creating predatory and unfair trading practices. This test program was initiated by complaints from the Buy Side Institutions.

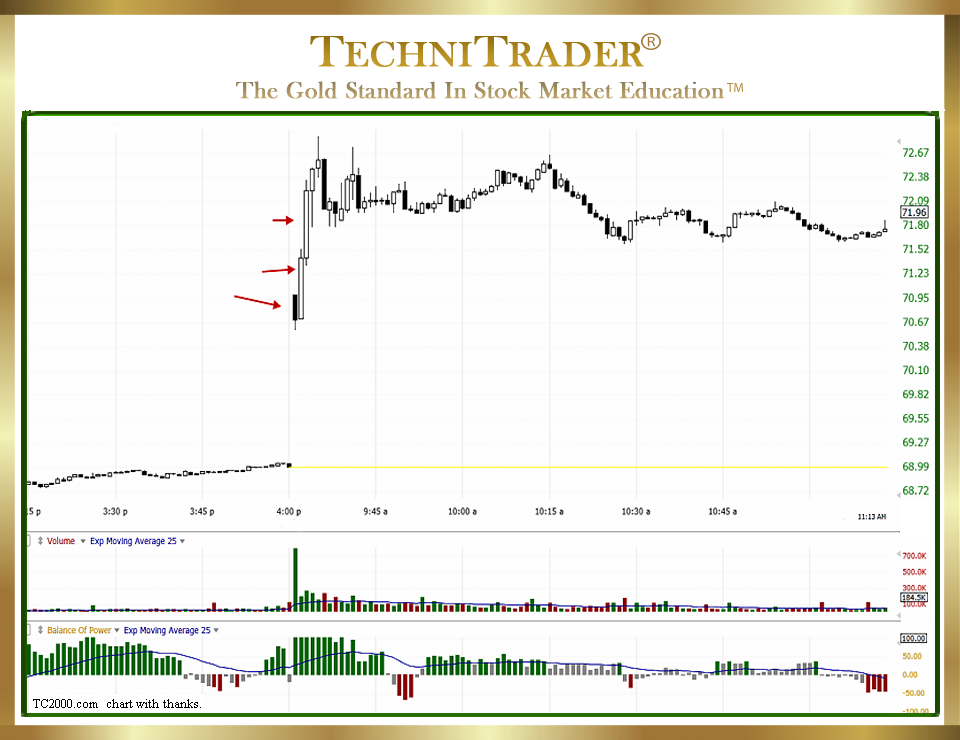

The 1-minute intraday stock chart example below shows the effect of High Frequency Trading activity in pre-market order flow, which is a huge gap up at market open.

The High Frequency Traders (HFTs) generally trade within 5 minutes of market open, but they are not active at all for the remainder of the day. Therefore, any liquidity they may offer as Maker-Takers is only present for a few minutes of the trading day. This may change if the SEC changes the rules governing HFT activity.

Maker-Taker is a term used to describe an agreement between an exchange and a High Frequency Trader or other liquidity provider. Maker refers to “making a market”, which is buying or selling whenever there is a significant number of buyers or sellers on one side of the market. The imbalance between buyers and sellers can harm the efficiency of the market, and that is why there are Market Makers. Takers remove liquidity from the market.

High Frequency Traders are mostly Maker-Takers, and as such, they are not required to Make a Market, aka buy or sell shares of stock when there is an imbalance of orders. This may be providing the opportunity for predation, which the SEC intends to discover with its new Test Pilot Program.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a TC2000 chart, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.