Why Use Balance of Power to Find Dark Pools?

For Identifying Stocks Poised for Momentum Runs

Balance of Power (BOP) is an extremely rare and unique indicator. Its origins come from the professional side of the market. It is designed to separate out large-lot activity from small-lot activity. This kind of stock volume aka quantity analysis on the tick-by-tick scale is not available on the retail side in any of the popular indicators most Retail Traders learn to use.

Being able to easily detect whether the large lots are selling or buying a stock versus the small lots buying or selling is a key element for finding excellent momentum action BEFORE it happens. Sure, most Retail Traders wait for a MACD crossover signal, but by then the run has been underway for a day to a few days and all that extra profit is lost.

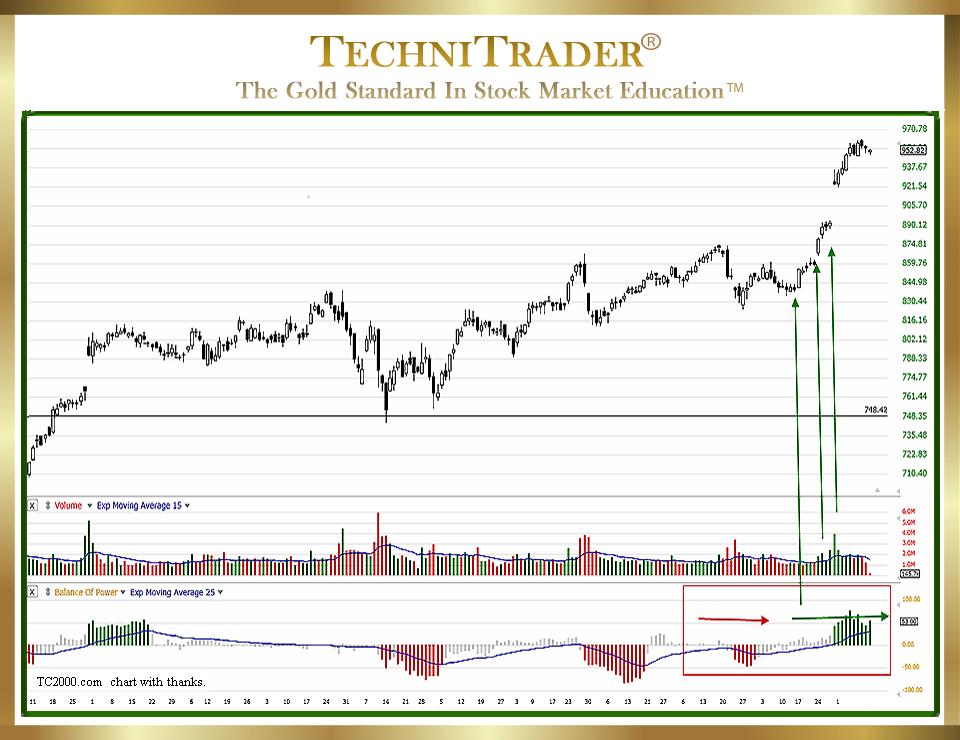

When markets have low volatility, using the Balance of Power indicator is the only way to find the Dark Pool Quiet Accumulation patterns that precede momentum action. Professional Traders can detect the liquidity draw as the Dark Pools buy or sell large quantities of shares while hidden in off-exchange trading venues.

Once a stock has gapped often hugely, the gains of that momentum run are limited at best. Entering before a huge gap should be the goal. Balance of Power provides the data needed to let you know when a stock is poised for momentum action.

How the Balance of Power Indicator Works

Balance of Power is not your everyday indicator. Most indicator formulas are simple and take less space than the length of this sentence. Balance of Power is 3.5 pages of formula and is highly complex in the way it distinguishes large lots from small lots. When there are more of the large lots than small lots, the Balance of Power shifts to that side, up or down. For instance, more demand on the buy side creates a liquidity draw on the Bid, causing prices to rise as demand is much higher due to large lots buying. Price then moves up.

Now, with complex automated and bracketed stock order types used by Professional Traders in Dark Pools, price is controlled while they are buying. This means price is not yet moving even while large lots are increasing the demand side of the transaction. This builds up energy and momentum before the stock price moves. Identifying this accumulation is impossible with MACD. This is because it is a price moving average indicator, and MACD can’t turn up UNTIL price moves up above the moving average.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a TC2000 chart, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.