What Is the Best Earnings Season Stock Trading Strategy?

Position Trading to Enter Stocks Earlier & Hold Prior to Earnings Release

Most Earnings Season Stock Trading Strategies involve trading either the stock or its options a few days before the Earnings Report is released. However, much of the gains are already over if you focus only on the few days ahead of the stock’s Earnings Report.

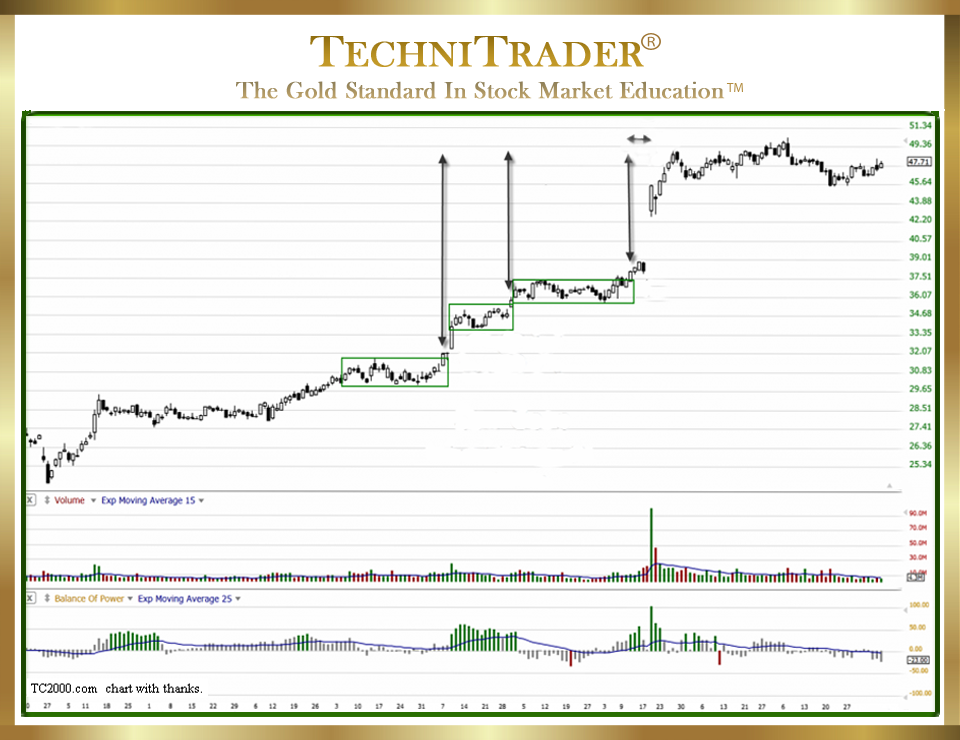

Example of a Position-Style Earnings Season Stock Trading Strategy

The chart below is a good example of an early position trade entry that provided excellent Return on Investment (ROI). An early Earnings Report entry resulted in an easy trade that required minimal effort to monitor but huge Return on Investment profits.

Earlier entries result in a higher number of dollars per share gained. Most Day Traders try to make a 10–20-cent gain on a trade. The net point gain for an entry with a hold through the gap and run is approximately 10 points, or $1,000 for a 100 share lot or $10,000 for a 1,000 share lot. It only takes one or two position trades a month to generate excellent income from trading stocks. The size of your share lot will be determined by your capital reserve.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a TC2000 chart, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.