What Are Causes of High Frequency Trading Front-Running Stocks?

List of 5 Includes Retail Trader Cluster Orders

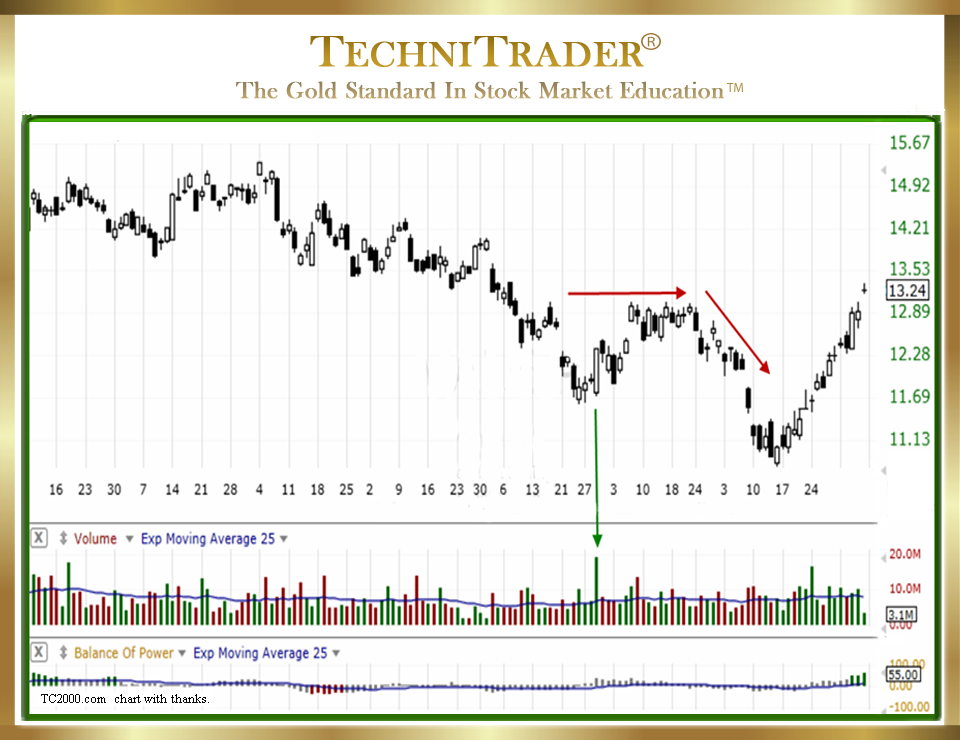

The chart example below shows High Frequency Trading high stock Volume spikes and long candlesticks. They attempted to drive price up as indicated by the green arrow, but the price quickly shifted sideways and then turned down again. The stock did not alter its trend. The second attempt tried to drive price down, which is the biggest black candlestick before the run up. However, the bottom for the Dark Pool Buy Zone™ had already been reached. The stock then commenced a sideways action of an early bottoming pattern.

Most Individual Investors and Retail Traders do not need to worry about High Frequency Trading front-running stocks. If investments for your long-term portfolio are with a large to giant Mutual or Pension Fund, these funds are using Dark Pools which are off-the-exchange transactions. The High Frequency Traders (HFTs) cannot see the orders to front-run them.

If you are a Retail Trader, remember that most of the orders placed with online brokers for Retail Traders are filled from that broker’s inventory. So, those orders never make it to the exchanges. If you are using Electronic Communication Networks (ECNs), most of those orders are not sent to the exchanges either.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a TC2000 chart, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2015–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.