How to Go Beyond Basic Candlestick Pattern Analysis

Recognizing Who Is Controlling the Stock Price

There is a plethora of analysis training on Candlestick Patterns and interpretation, and yet this remains one of the most problematic areas for Technical Traders who want to trade at the expert level earning high income from just trading stocks.

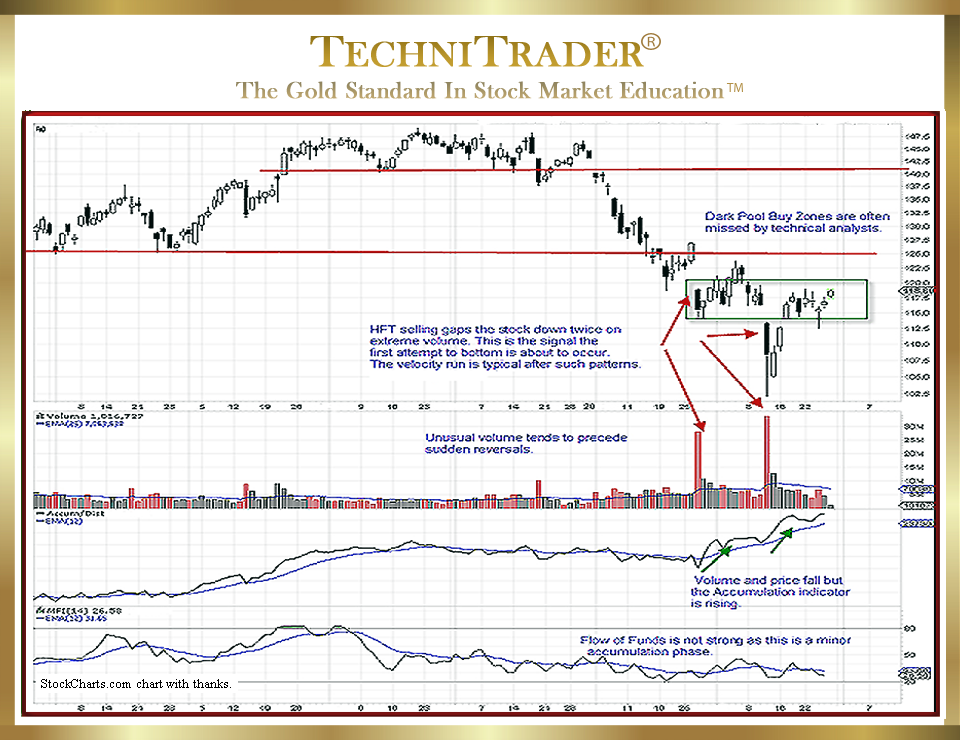

The candlestick chart example below shows an excellent example of Candlestick Patterns for Swing Trading.

The stock has stalled right at the first tier of bottom resistance, which tends to be weaker when quantities of larger lots start to accumulate.

See where High Frequency Traders (HFTs) took control of price and gapped the stock down for one day. Selling did not continue the following two days, and stock Volume was above the Exponential Moving Average (EMA) but much lower than the High Frequency Traders’ spiking stock Volume pattern.

This was the first accumulation level for this stock. Dark Pools started buying the stock even though High Frequency Traders who typically miss this initial buy mode of the giant Buy Side Institutions drove price down in a second gap down.

This was the next most important candlestick. This gap down opened the trading day, running down 5 points further over the next few minutes.

So, within 10 minutes of open, this stock moved several points. However, the long tail reversal was a key signal to those Swing Trading that this extreme pattern had entered a Dark Pool Buy Zone™ of the giant Buy Side Institutions.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a StockCharts chart, courtesy of StockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.