Why Does MACD Give False Signals?

Best & Worst Market Conditions for Using MACD

MACD has several key elements that are important to know if you intend to use this indicator as a primary entry signal for Buying Long, Selling Short, or Options Trading. Despite the fact that MACD is extremely popular, empirical evidence shows that most Retail Traders using MACD are not consistently successful. Many are baffled by the fact that sometimes MACD works, while other times it fails completely. They endure frequent whipsaw trades that quickly wipe out small gains because MACD gives false signals during certain Market Conditions.

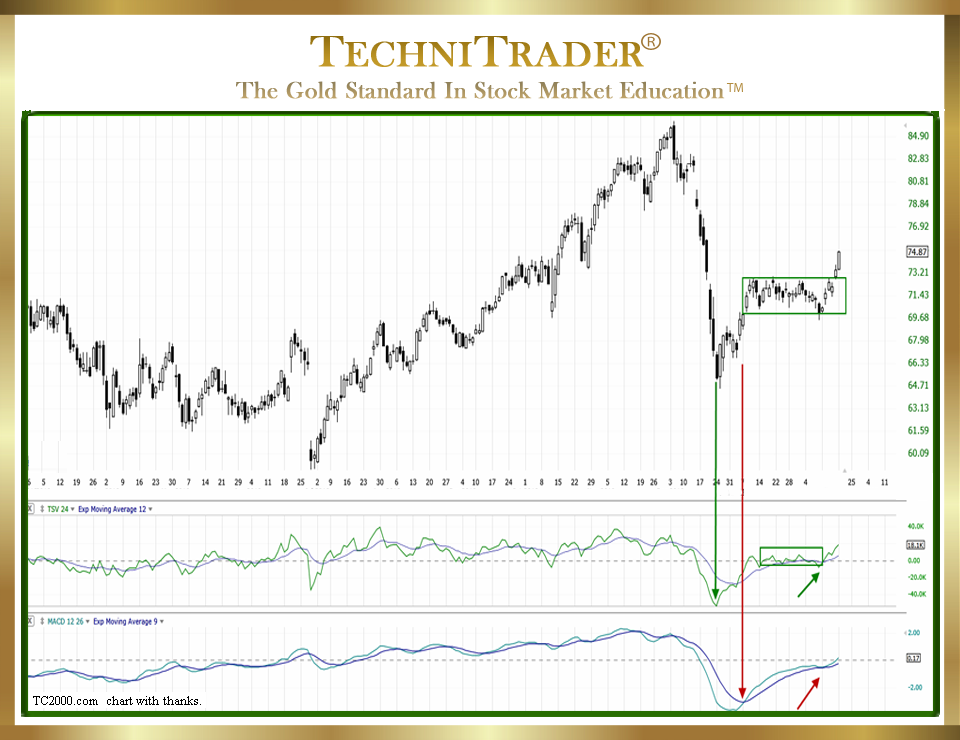

See the chart example below, which shows a Platform Market Condition where MACD gives false signals and also a Velocity move out of a bottom where MACD performs best.

The first thing to understand is that MACD is a Price and Time Momentum Indicator. This means that the price must move before the signal can form on MACD.

Therefore, MACD cannot lead price like several of the stock Volume-based Indicators do. Consequently, you would be entering the stock after the initial price move up or down, which can be an asset or liability depending upon the Market Conditions and Trading Conditions at the time.

A Trading Condition is the trading environment at a particular point in time such as Intraday, Daily, or even Weekly. Market Condition is the overall type of price action that is most prevalent among the 6,000+ stocks listed on the Stock Market Exchanges. These are two entirely different conditions, but they work in harmony as well.

MACD is a Price and Time Momentum Indicator that employs two Moving Averages to create the crossover signal for an entry.

A list of the best Market Conditions for MACD to work optimally are:

- Moderately Trending

- Velocity

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a TC2000 chart, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.