How to Track Large-Lot Institutions

Learn to Identify Candlestick Patterns in Charts

The main challenges Individual Investors and Retail Traders face today are figuring out when High Frequency Traders (HFTs) are going to suddenly appear and when Buy Side Institutions using Dark Pools are quietly buying or selling. There are distinct candlestick and indicator patterns for tracking the Large-Lot Institutions that use Dark Pools which repeat over time.

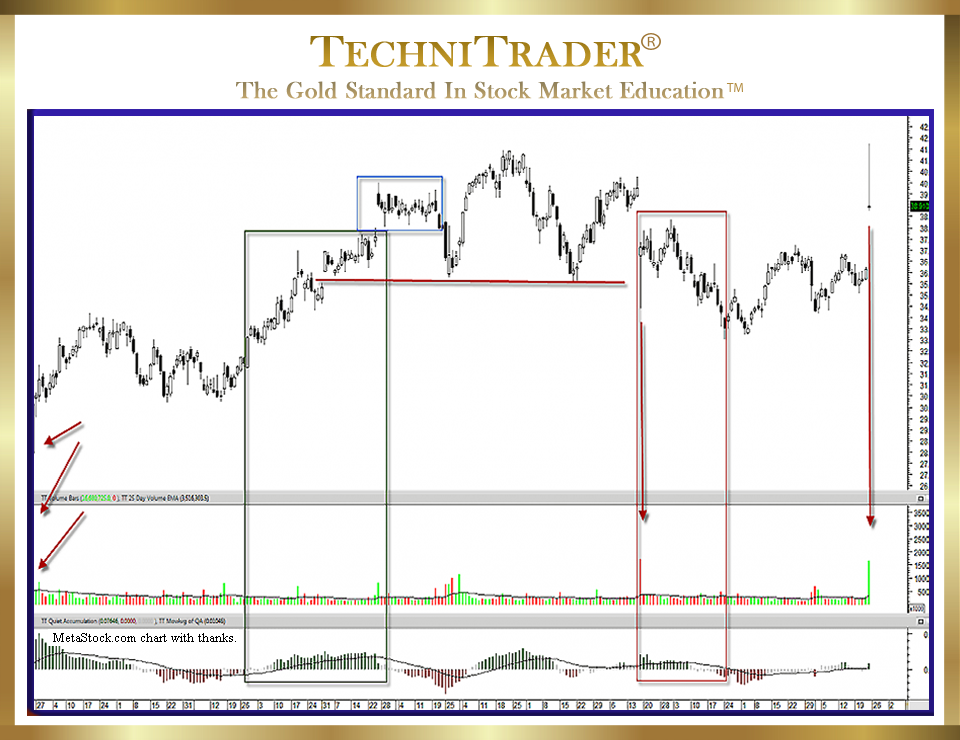

See the chart example below.

The first candlestick indicated by the red arrows on the far right is High Frequency Traders, which is evident in Price, stock Volume, and the TechniTrader Quiet Accumulation (TTQA) indicator.

The green vertical rectangle is Dark Pools and Professional Traders buying. Dark Pools are accumulating, while Professional Traders are trading short-term. The small blue horizontal rectangle is the high price range or top-level price for the Dark Pool Quiet Accumulation buyers. They will not buy any higher than this, which means Professional Traders are going to take profits.

That brings the price down to the support low, which is the trigger level for more Dark Pool Quiet Accumulation. Meanwhile, Dark Pool Quiet Accumulation is still going on, while uninformed Retail Traders are trying to sell this stock short. They struggle to push price down, but due to the lack of numbers, they are unable to control price.

As Dark Pool Quiet Accumulation ceases, High Frequency Traders gap down price at market open and then drive it down on an inconsequential retail news item, and Dark Pool Quiet Accumulation drives it right back up.

But Smaller Funds chase High Frequency Traders trying to sell or Sell Short. It goes deeper this time as giant Buy Side Institutions wait to begin Dark Pool Quiet Accumulation and then start buying again. This is discovered by High Frequency Traders, who gap price up with high stock Volume.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a MetaStock chart, courtesy of Innovative Market Analysis, LLC dba MetaStock

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.