Trading the Small Cap Stocks

About Outstanding Shares and Momentum Runs

Most Retail Traders only trade big cap stocks. This is because they depend mostly on news for finding stocks to trade. It can also be due to relying upon Industry or Sector selections, often missing out on the underlying stocks that are moving with momentum but are not a major index component.

Why trade small caps? It is because the spreads are now 5 cents, and that provides more liquidity and momentum, as more Professional Traders are trading small caps due to the rules for spreads on small cap stocks.

Why do small caps have such huge sudden momentum runs? It is because small caps usually have less outstanding shares than big caps.

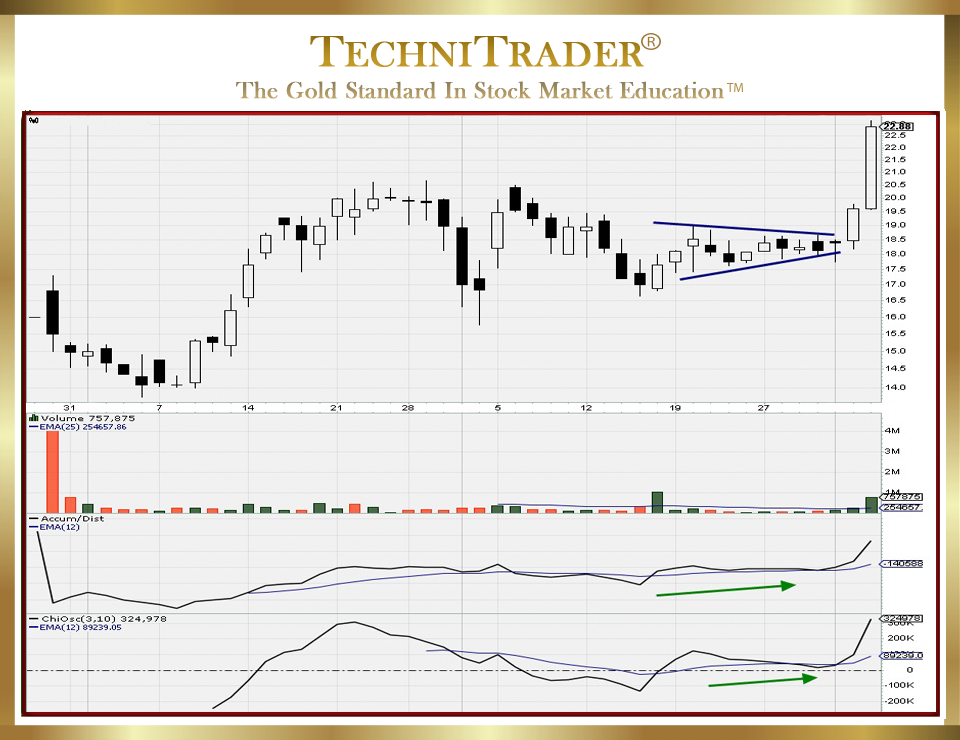

An example of a big cap would be a stock with 7,775 million outstanding shares. By comparison, an example for trading the small caps would be a stock with 67 million outstanding shares. See a chart example of a small cap stock with 67 million outstanding shares below.

The candlestick pattern compressed and then moved up 2 days in a row. The higher number of outstanding shares, the more buyers are needed to move a stock with momentum. With a small cap under Dark Pool Quiet Accumulation, the limited number of outstanding shares can increase momentum exponentially as demand suddenly rises. It does not take nearly as many buyers to create huge momentum.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a StockCharts chart, courtesy of StockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.