Day Trading vs. Position Trading Stocks Comparison

Differences in Styles, Costs, and Profits

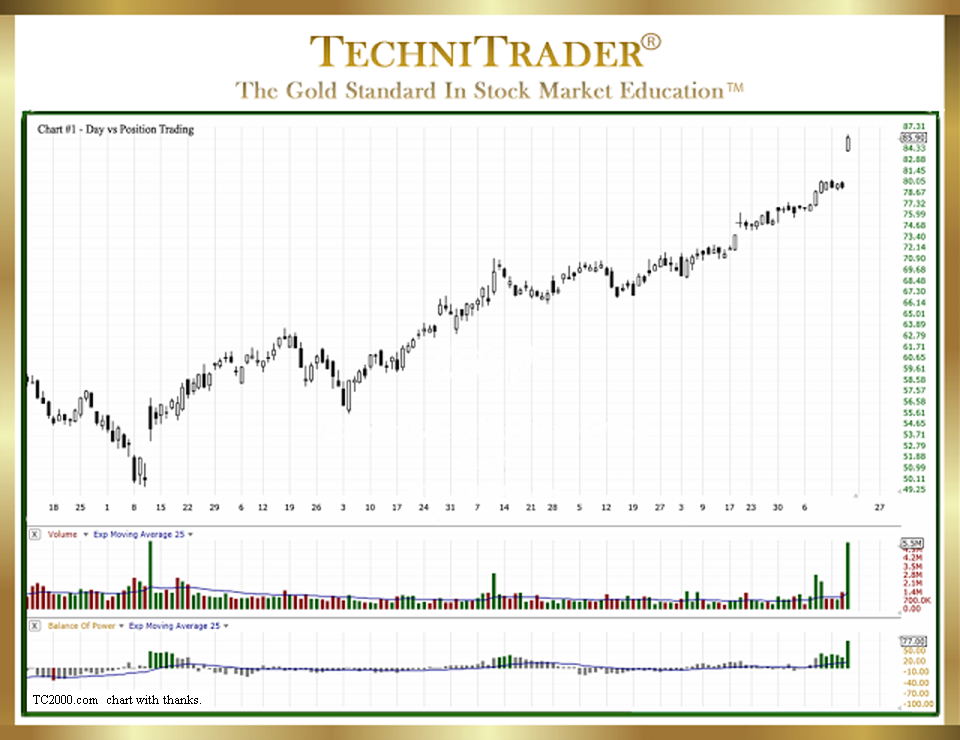

Day Trading is the most widely talked about Trading Style for Retail Traders. However, it is the least profitable of all the short-term Trading Styles. This is a little-known fact that no one ever tells Retail Traders when they start to learn to trade because so many vendors make so much money from Retail Day Traders. Position-Style Trading is the least used and yet most profitable Trading Style for more Market Conditions than other styles. Candlestick chart example #1 below is of a Position Trade.

The entry by most Retail Traders would have been made as the stock completed its bottom around $62. In just over 3 months, the total gained is approximately 22 points for one trade, so trading costs are minimal in comparison to profits.

Not a bad return for a few hours a week effort, a few dollars in broker fees, and a scant $30 a month for a charting program. Well worth the effort, tool costs, and your time. That equates to $22,000 on a 1,000 share lot trade.

Position Trading is lucrative as stocks move out of bottoms and begin Platform-Building or Moderately Trending Patterns.

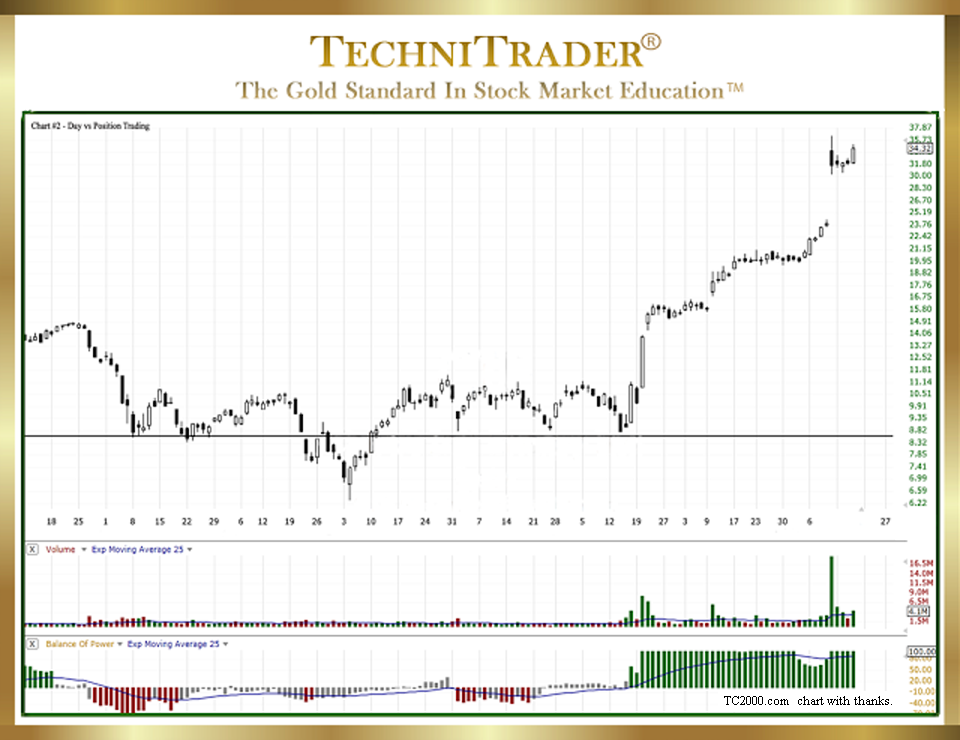

Candlestick chart example #2 below is of a Position Trade still underway with continued upside potential. Again, the entry was at the completion of the bottom.

The allure of Day Trading is that it is the “ultimate” style, pitting the trader against the wily Market Makers. The cost of Day Trading using the proper tools, time required to do it right, and lower percentage of profitable trades all consume more profits than any other Trading Style.

Market Makers have a far less important role these days due to the automation of the marketplace and the extremely high liquidity generated by High Frequency Trading Firms (HFTs), who actually provide the liquidity that used to come from the Market Makers.

So, what Trading Styles are the most lucrative?

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using TC2000 charts, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.