What Is the Hidden Power Within Candlestick Charts?

A Buy Entry Signal Candlestick Pattern

Most traders do not leverage the full potential of Candlestick Charts when trying to find stocks to trade. Often, they spend more time searching for a reversal or continuation pattern than they do putting on stock trades to make money. Your time is money spent whether you realize it or not. You are worth a certain dollar amount per hour, so every hour you are spending studying Candlestick Trading Patterns is costing you money.

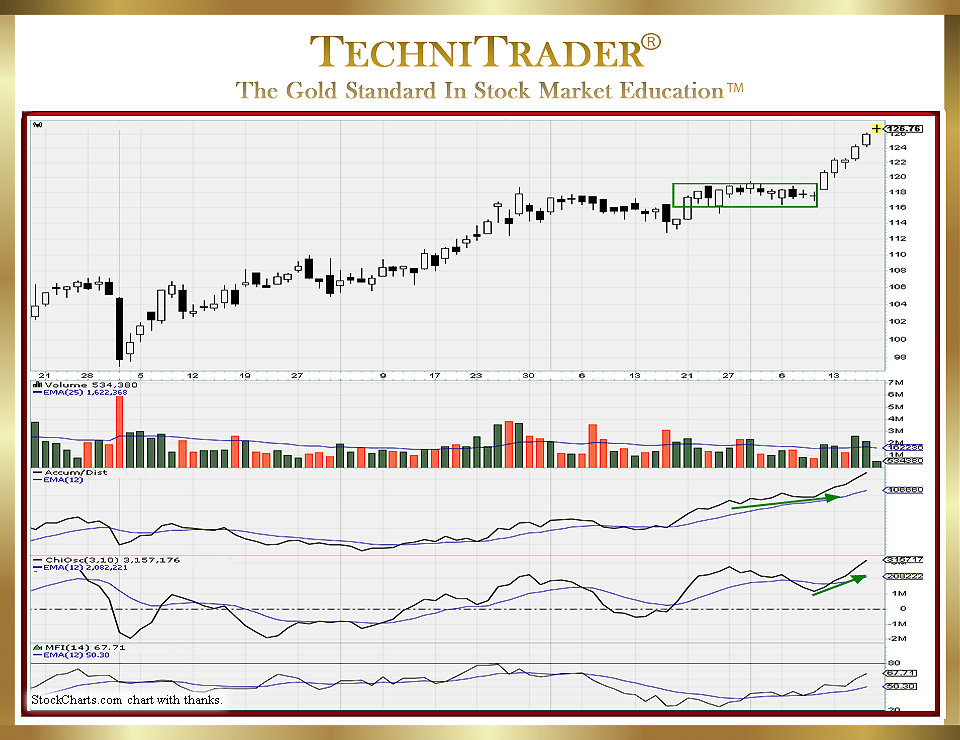

See the chart example below.

Professional Traders who mostly use candlesticks have methods and processes that streamline their Candlestick Chart Analysis into a simple and reliable approach.

Retail Traders need to learn how to simplify and consolidate tasks in order to make trading stocks easier and more enjoyable as well as more profitable.

The first aspect of Candlestick Charts all traders need to accept is that most of what you have learned about candlesticks to this point is the reversal and continuation patterns for the Commodity Rice Exchange Market of ancient Japan.

A BUY ENTRY SIGNAL Candlestick Pattern reveals the 10 following things:

- The energy behind the price action.

- The trigger initiator for the run, which defines the Trading Style to use.

- The sustainability of that run, aka how long it is likely to last.

- How far the stock can run, aka how many points remain in this current run.

- Who is controlling price: Is it Dark Pools, High Frequency Traders (HFTs), Professional Traders, Smaller Funds, or Retail Traders? Whoever controls price MATTERS, as that is part of how long the run will keep running.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a StockCharts chart, courtesy of StockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.