How Does a Percentage Stop Loss Trigger High Frequency Traders?

They Trigger on Algorithms Designed to Locate Cluster Orders

The uptrend and the downtrend are not mirror images of each other, nor can you use the exact same indicators, indicator period settings, or subordinate indicators. The downtrend can drop and gap down on low stock Volume because a percentage stop loss triggers High Frequency Traders (HFTs).

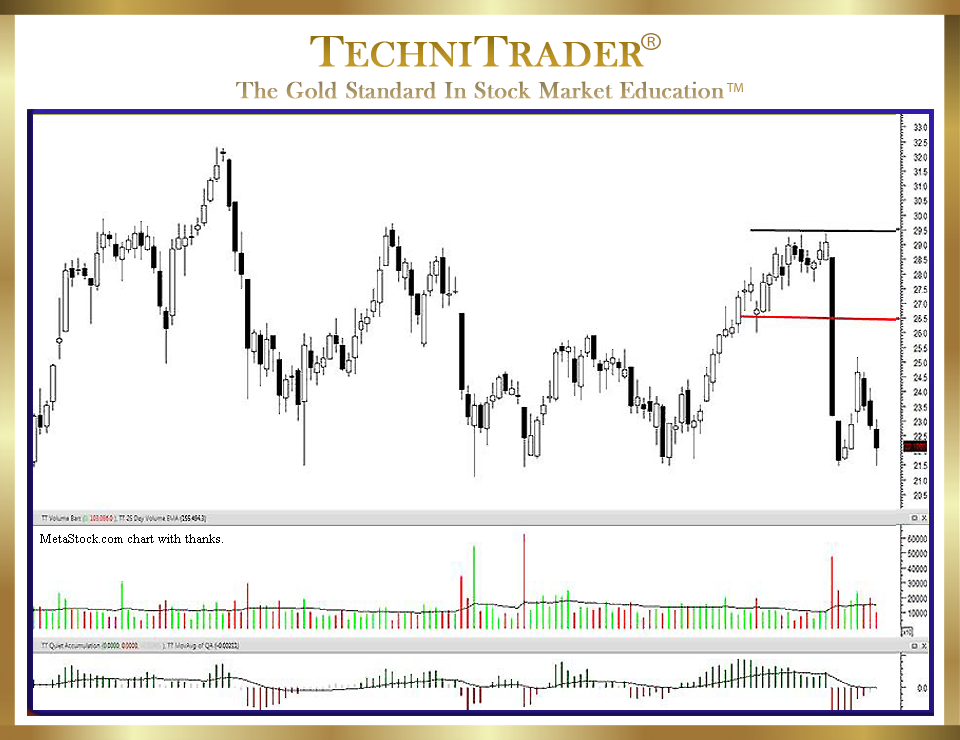

The candlestick chart example below shows how a 10% stop loss triggered a huge down day.

It was driven by very high stock Volume, which is the footprint of High Frequency Traders and Sell Short automated orders. These trigger on algorithms designed to locate Cluster Orders.

Many Retail Traders assume that if they learn the upside price action that when the trend turns down, it is just the opposite price action of the upside. That is why so many Retail Traders struggle to exit stocks before the trend tops and runs down. In addition, it is also why many Retail Traders who try to Sell Short as well as Options Traders who buy Puts take so many losses in their trading.

For Position Trading, you will be trading the uptrend and the sideways trend. For Swing Trading, you must trade the uptrend and the downtrend and adapt for the sideways trend. When you are Swing Trading, you must be able to take advantage of both the upside and downside price action in order to net profits that are close to what Position Trading can achieve. However, Position Trading will generally always have far higher returns.

The Sell Side or downtrend is very different from the uptrend and the sideways trend because there are fewer Stock Market Participant Groups. Giant Buy Side Institutions who invest in Mutual and Pension Funds do not Sell Short.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a MetaStock chart, courtesy of Innovative Market Analysis, LLC dba MetaStock

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.