Why Use the TechniTrader® Flow of Funds (TTFF) Indicator?

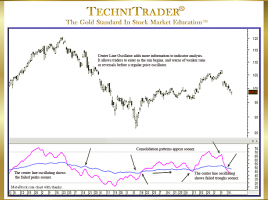

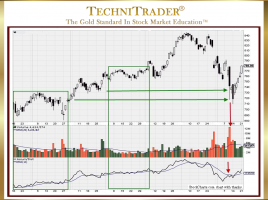

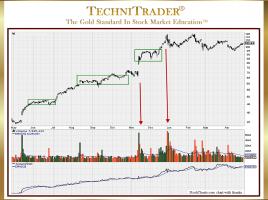

Determine Stock Market Participant Groups Buying or Selling Stock The TechniTrader Flow of Funds (TTFF) indicator was designed for MetaStock Users and to help Retail Traders and Individual Investors see when giant Buy Side Institutions are moving into or out of a stock. There are currently over 12,000 Institution Funds …