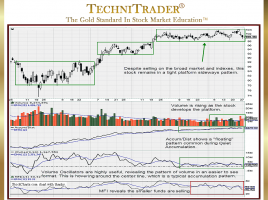

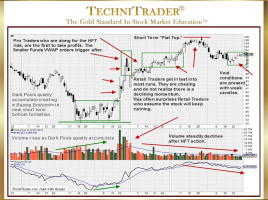

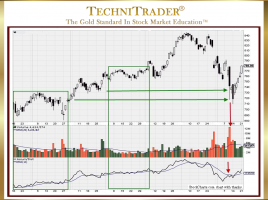

Why Analyze Price, Stock Volume, & Accum/Dist Indicator Combined?

Identify Stock Market Participant Groups by Price & Indicator Patterns The StockCharts.com indicator Accum/Dist was designed to help track the large-lot versus small-lot activity. Decades ago, when the concept of distinguishing between the large lots versus the small lots started being discussed by the Sell Side Institutions, the Stock Market …