What Are the Differences Between Sell Short & Buying Long?

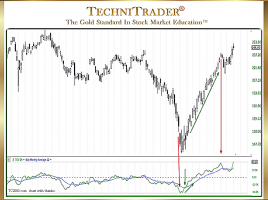

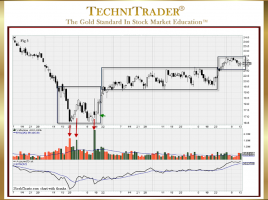

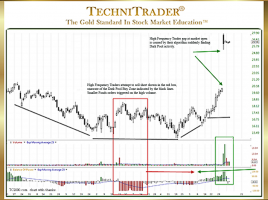

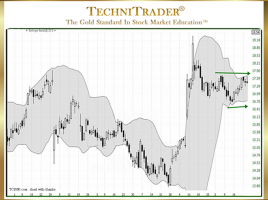

List Explains and Includes Stock Volume, Energy, & Support Stocks move upward in fairly typical patterns that occasionally alternate and shift for instance from Stairstep Candlestick Patterns to Peaks and Valleys. But the sell side of the market can often drop like a dead weight. An uptrend looks like a …