Why Learn Dark Pool Candlestick Patterns?

To Enter Stocks Prior to Velocity Runs

Dark Pools use precise controlled orders that trigger automatically over extended periods of time. Since the Buy Side Institutions using the Dark Pools are primarily buying for the long term, price can sometimes drop down before moving up. This tendency often leaves Retail Traders on the wrong side of the trade.

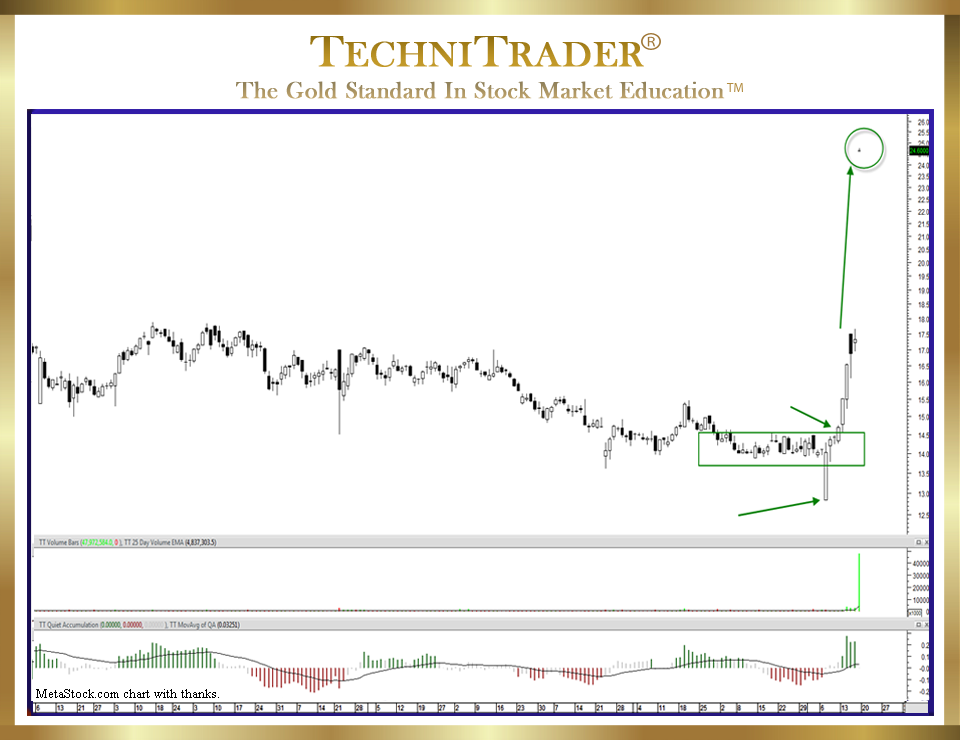

Using an indicator that exposes the Dark Pool incremental buying gives Retail Traders an edge even High Frequency Traders (HFTs) do not have. During this period, the stock slipped down slightly, but it remained well within the Dark Pool Buy Zone™ that had been created. Below is a chart example of a stock under Dark Pool Quiet Accumulation for several months.

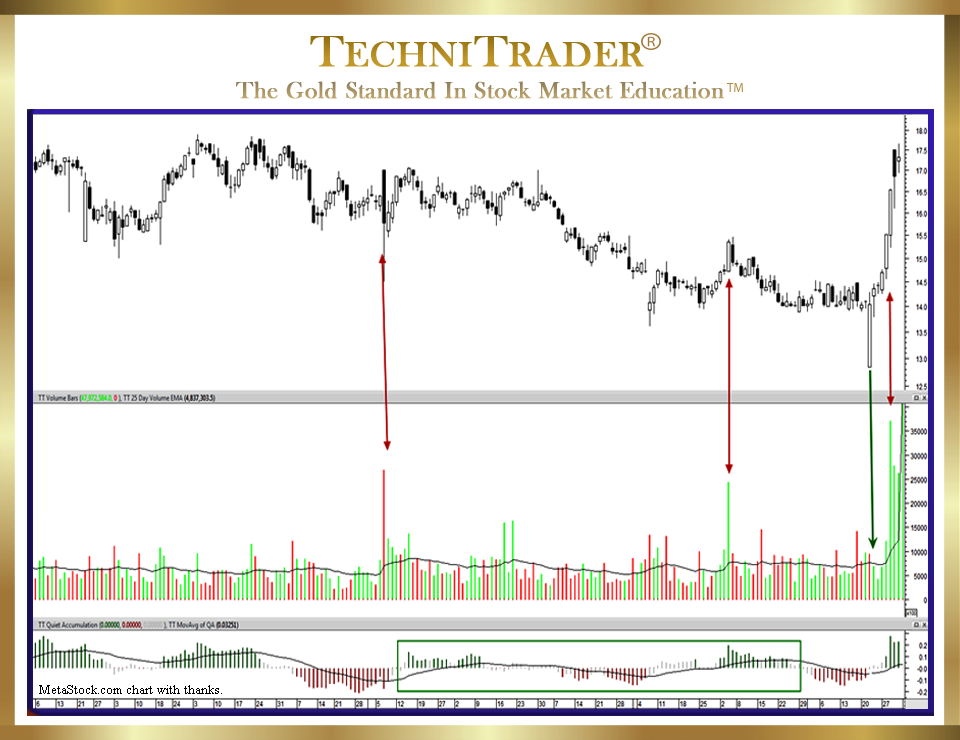

The enormous stock Volume that occurred on the day of the High Frequency Traders’ gigantic gap up distorts the stock Volume Indicator history. Below is the chart showing how the stock Volume Indicator appeared prior to that big gap.

High Frequency Traders attempted to sell the stock down a couple of times, but Dark Pools were triggering buys during that period of time. Smaller Funds were following High Frequency Traders with Volume Weighted Average Price (VWAP) orders and often sold when they should have been holding. Smaller Funds Managers typically have less experience and rarely use individual stock Technical Analysis for their buys and sells.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using MetaStock charts, courtesy of Innovative Market Analysis, LLC dba MetaStock

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.