What Is Dark Pool Quiet Rotation™?

Candlestick Patterns Explained with Stock Indicators

Most Technical and Retail Traders have heard about Buy Side Institutions’ Dark Pool Quiet Accumulation and Quiet Distribution, but few understand another institutional action which is Dark Pool Quiet ROTATION.

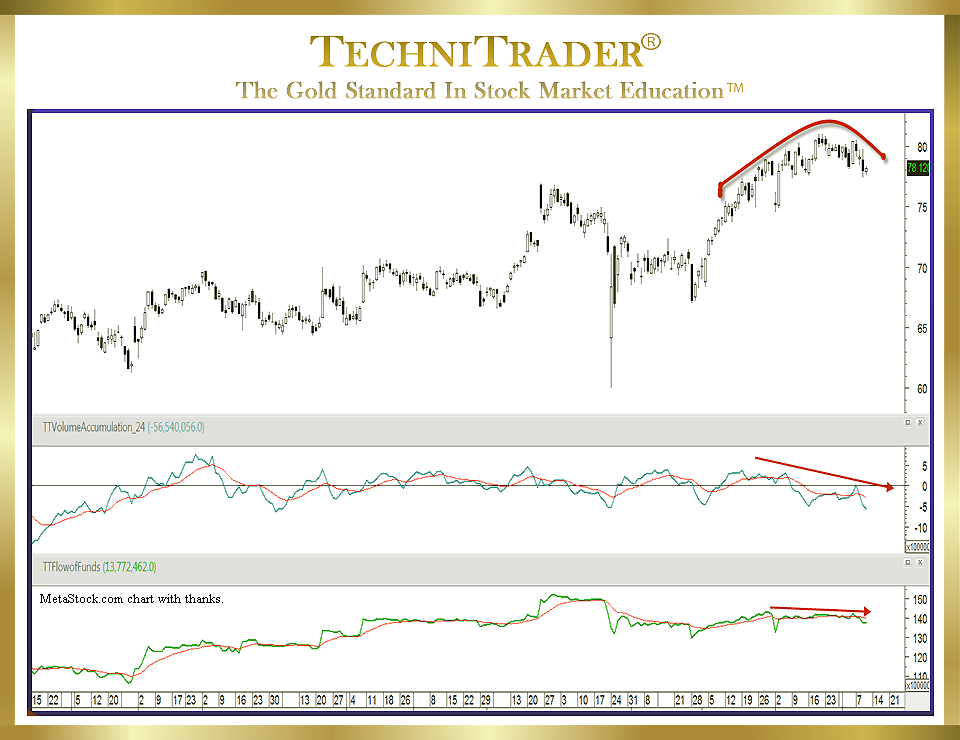

The candlestick chart example below with a monthly view shows the commencement of a Rounding Top Candlestick Pattern that developed due to steady Dark Pool Quiet Rotation.

This stock is slowly losing institutional percentage holdings as the giant Buy Side Institutions quietly rotate out. Their goal is to not disturb the uptrend buying frenzy of Individual Investors, new Investors, and Retail Traders who rely upon recommendations and gurus for stock picks. As the stock moves up with smaller-lot buyers who have less capital than the giant institutions, the trend slowly bends under the weight of the large to giant-lot Rotation.

This is a critical pattern to recognize for Technical Traders and Retail Traders especially in highly popular recommended stocks, as weakening trendlines due to Dark Pool Quiet Rotation are harder to see in candlesticks early on.

Accumulation is the acquiring of hundreds of thousands to millions of shares of stock over an extended period of time. Dark Pool Quiet Accumulation is the most common nowadays which is when Buy Side Institutions use Dark Pools aka Alternative Trading Venues, which do not show their activity on the exchanges.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a MetaStock chart, courtesy of Innovative Market Analysis, LLC dba MetaStock

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.