What Is the Stock Market Participant Groups Cycle?

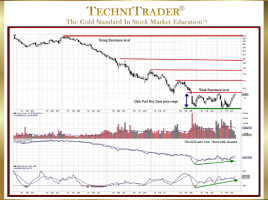

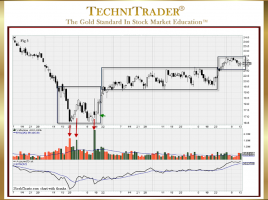

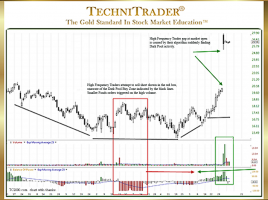

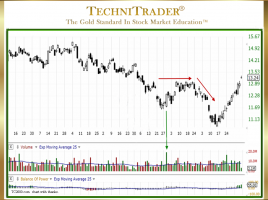

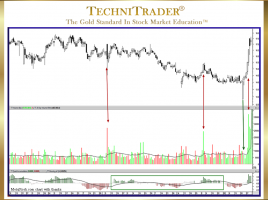

Candlestick Patterns Show Which Group Is in Control of Price The Stock Market Participant Groups Cycle occurs in visual candlestick patterns on the charts, and analysis should be confirmed with appropriate indicators. The following is a breakdown of how Stock Market Participant Groups move price in specific ways with the …