What Is Missing in Your Risk Analysis?

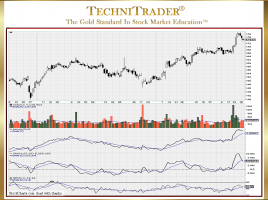

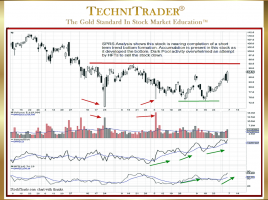

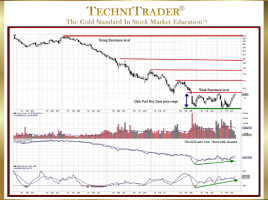

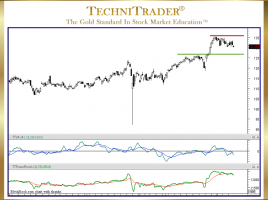

Stop Loss with Support & Resistance The least used and most often improperly used analysis by Technical Traders and Retail Traders is Risk Analysis. All too often, traders are choosing high-risk stock picks without realizing it. See the candlestick chart example below. This analysis is NOT using percentages, but rather …