What Causes Common Gaps in Candlestick Patterns?

Overnight Order Flow of Market Orders & Limit Orders

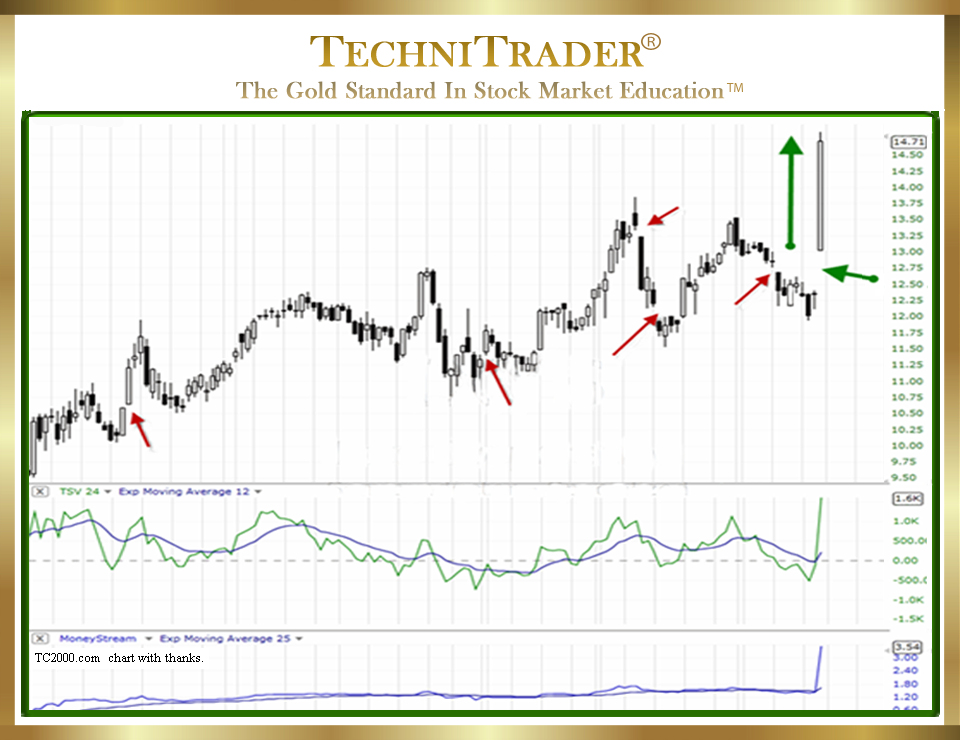

Many Retail Traders really enjoy trading gaps because of the higher point gains that come quickly. But in order to reap the gains from a gap, you must be in the stock PRIOR to the gap. Chasing a gapping stock or trying to buy a stock that has gapped and is running is a much higher risk. The chart example below shows Common Gaps in Candlestick Patterns.

Common Gaps nearly always fill. This means that the stock price will move in the opposite direction of the original price move that caused the gap. So, if a stock has a Common Gap that moves price up, in a few days the price will move down and “fill” the gap before resuming its intended path.

Gaps that are common are usually filled by Intraday or Short-Term Traders taking profit quickly. So, always be aware when a Common Gap has occurred, and then you can avoid many untimely entries.

In this chart example, the two green arrows point to the last gap, which is NOT a Common Gap or a Breakaway Gap. Breakaways are strictly gaps that jump completely over and above resistance. This gap did not jump over resistance completely.

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a FreeStockCharts chart, courtesy of Worden Bros. and FreeStockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.