Why Use Chart Trends with Trendline Candlestick Patterns?

New Western Candlesticks Have Entry Signals in Trendline Patterns

Traders learn about Trends Up, Down, and Sideways, which are the commonly taught Trends. There is also the Long-Term Trend (which is sometimes called the Primary Trend), the Intermediate-Term Trend, and the Short-Term Trend. However, few traders learn the Trendline Patterns.

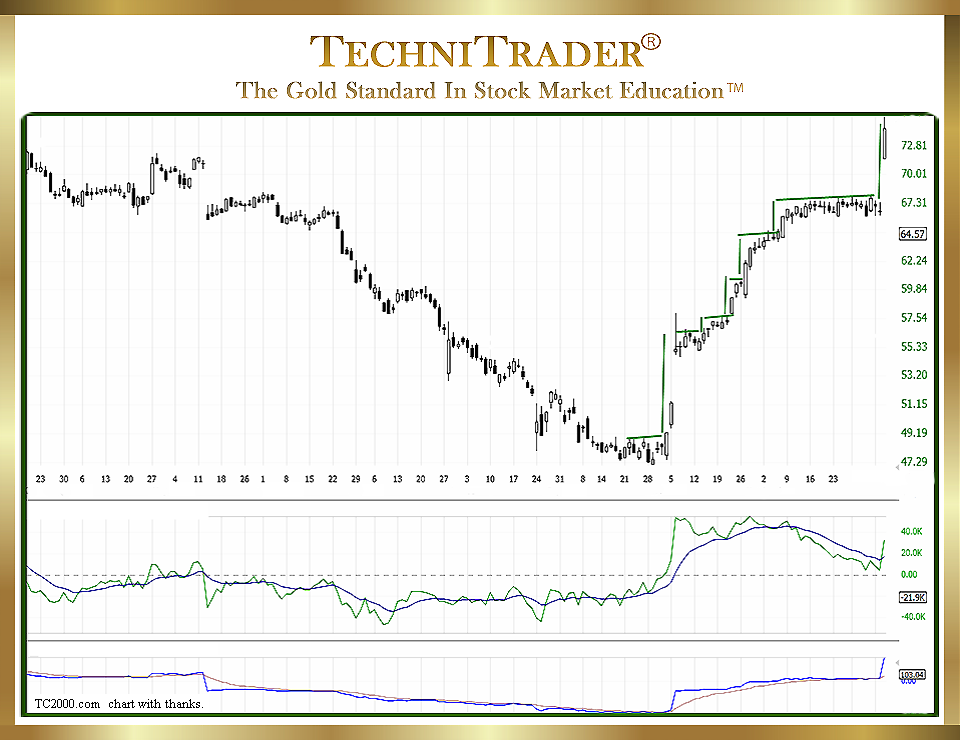

As an example, a very common Trendline Pattern for Swing Trading is the Stairstep Trendline Candlestick Patterns. See the candlestick chart example below.

This looks exactly like what the name implies. It only forms on the Short-Term Trend, and it is a Momentum Energy Pattern that is ideal for Swing Trading.

All Chart Trends have Trendline Candlestick Patterns. Each pattern is how price behaves over and over during a period of time when a specific Stock Market Participant Group controls price. These patterns can repeat for a few weeks, a few months, or over a year. All Trendline Patterns change as various Stock Market Participant Groups cease to control price, and a new group takes over.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a FreeStockCharts chart, courtesy of Worden Bros. and FreeStockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.