What Is Dark Pool Quiet Rotation™?

Candlestick Patterns Explained with Stock Indicators

Most Technical and Retail Traders have heard about Buy Side Institutions’ Dark Pool Quiet Accumulation and Quiet Distribution, but few understand another institutional action which is Dark Pool Quiet ROTATION.

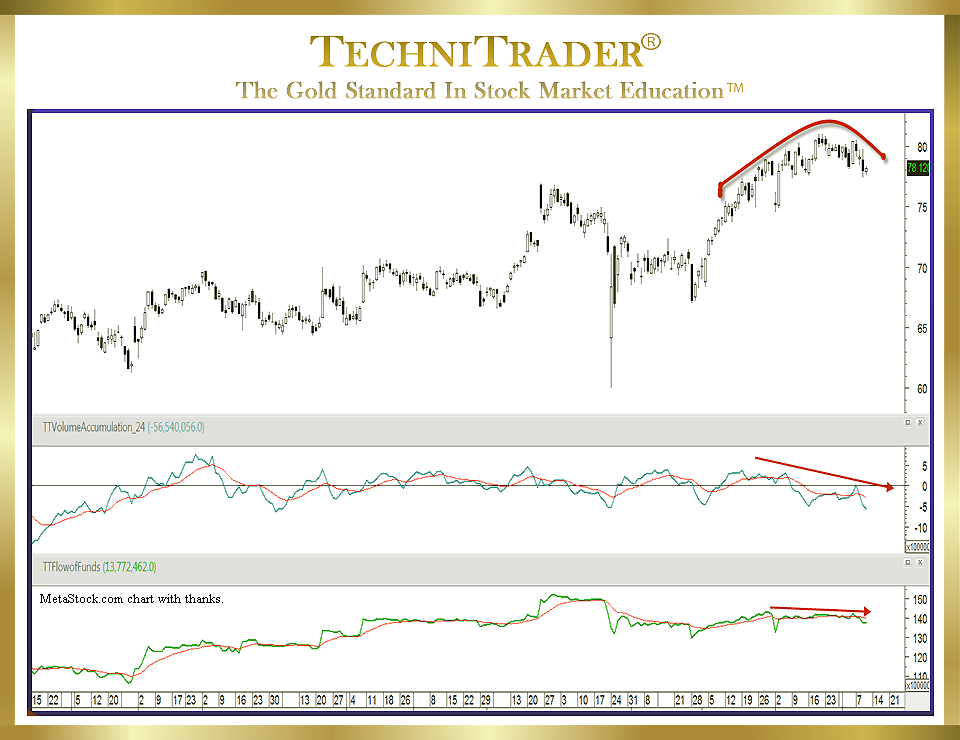

The candlestick chart example below with a monthly view shows the commencement of a Rounding Top Candlestick Pattern that developed due to steady Dark Pool Quiet Rotation.

LEARN MORE at TechniTrader.Courses

This stock is slowly losing institutional percentage holdings as the giant Buy Side Institutions quietly rotate out. Their goal is to not disturb the uptrend buying frenzy of Individual Investors, new Investors, and Retail Traders who rely upon recommendations and gurus for stock picks. As the stock moves up with smaller-lot buyers who have less capital than the giant institutions, the trend slowly bends under the weight of the large to giant-lot Rotation.

This is a critical pattern to recognize for Technical Traders and Retail Traders especially in highly popular recommended stocks, as weakening trendlines due to Dark Pool Quiet Rotation are harder to see in candlesticks early on.

Accumulation is the acquiring of hundreds of thousands to millions of shares of stock over an extended period of time. Dark Pool Quiet Accumulation is the most common nowadays which is when Buy Side Institutions use Dark Pools aka Alternative Trading Venues, which do not show their activity on the exchanges.

Buy Side Institutions are able to hide their 100,000–500,000 share-lot activity from High Frequency Traders (HFTs), Individual Investors, Retail Traders, and Small Mutual Funds and Small Pension Funds Managers by using the Dark Pool venues.

This enables them to buy large to giant quantities of stock over time without disturbing price. The primary difference between exchange activity and Dark Pool activity is the ability of the Buy Side Institutions to not alter the trend that is underway at that time.

Accumulation INCREASES the amount of money in the Stock Market fueling Bull Markets and uptrends, even though the institutions buy in such a way so that price does not move much when they are buying.

LEARN MORE at TechniTrader.Courses

Distribution is the selling of a large quantity of stock over time, OR because of redemption demands.

High redemption demands tend to occur near the end of an Intermediate-Term Correction or a Bear Market.

Therefore, Dark Pool Quiet Distribution is often faster than Dark Pool Quiet Accumulation. Dark Pool Quiet Distribution is when Buy Side Institutions sell huge quantities of stock without moving price much.

Distribution removes money from the Stock Market, which fuels more downside selling.

Rotation candlestick patterns occur during the middle to final years of a Great Bull Market, which is a Bull Market that lasts for more than 4 years. Dark Pool Quiet Rotation is the systematic and carefully calculated selling of shares of one stock and the buying of another stock. Dark Pool Quiet Rotation patterns tend to slowly bend trends either in a Bowl Bottoming Candlestick Pattern OR in a Rounding Top Candlestick Pattern. Platforms are also a common pattern for Dark Pool Quiet Rotation in or out of a stock.

Summary

What is essential to have are indicators that reveal the Dark Pool Quiet Rotation patterns before price begins to bend and round, which can create whipsaws resulting in losses that could have been avoided when Swing Trading or Day Trading.

The TechniTrader Volume Accumulation (TTVA) and TechniTrader Flow of Funds (TTFF) indicators clearly show the steady Dark Pool Quiet Rotation pattern over time, even as price moves up. This allows the Technical and Retail Traders to avoid entering a stock that is actually weakening into a Rounding Top Candlestick Pattern rather than what at first may appear to be merely a consolidation or sideways candlestick pattern.

By recognizing Dark Pool Quiet Rotation candlestick patterns early on, Technical and Retail Traders can be better prepared for Market Corrections and learning to Sell Short if they are Swing Trading or Day Trading.

LEARN MORE at TechniTrader.Courses

If you have not yet begun to trade or invest, go to Introduction: Learn How to Trade Stocks – Free Video Lesson to get started.

Learn the steps to trade like a pro with this introductory mini course. You will learn what it takes to create a Professional Trading Plan that can help you achieve your trading goals: How to Create a Professional Trading Plan

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a MetaStock chart, courtesy of Innovative Market Analysis, LLC dba MetaStock

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.