How to Find Stocks to Trade Faster

5 Tips Include Identify Candlestick Price Action

Oftentimes, traders just cannot find great stock picks quickly and easily. This leads many traders to resort to relying upon news, recommendations from gurus, social media, or online trading chat rooms. Unfortunately for those traders, High Frequency Traders (HFTs) and other predatory systems can easily track and exploit Retail Traders who are using any of the above for their stock picks.

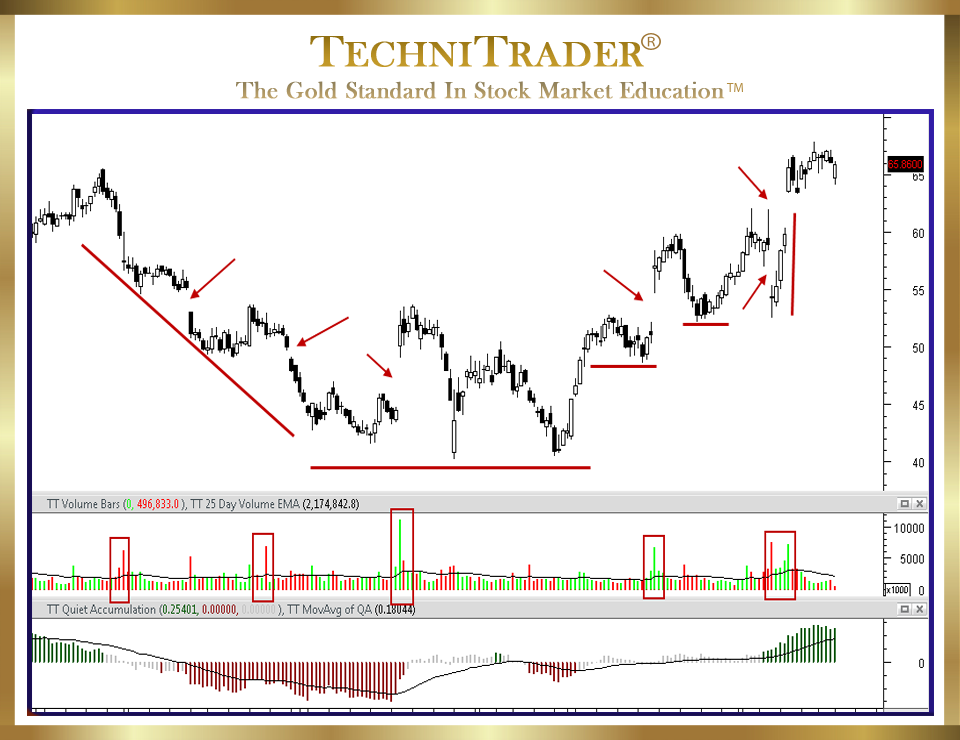

The candlestick chart example below is volatile.

LEARN MORE at TechniTrader.Courses

Volatility, whipsaws, and weak follow-through runs are all caused by predatory systems. These include High Frequency Traders, Professional Traders, and even Retail Brokers due to the anomalies in order flow caused by all of the common ways that Retail Traders find stocks to trade.

Many Retail Traders still blame “Market Makers”, which is a common myth. However, 99% of all small-lot orders are now fully automated, circumnavigating the Market Makers entirely in both the Stock Market and the Options Market.

Instead, the real culprit to volatile price action, whipsaw action, poor fills, and lousy runs that do not net sufficient gains for profitable trades is Cluster Orders. These happen when too many Retail Traders are all attempting to trade the same stock at the same time using the same “trading system” or “stock trading strategy”.

LEARN MORE at TechniTrader.Courses

Here are 5 Tips to Finding Stocks to Trade Faster:

- Know what price action precedes volatility, which is often a compression candlestick pattern.

In the candlestick chart example above, price moves often in what appears to be unexpected up-and-down action which is often gapping. By recognizing price patterns that precede sudden moves, traders can take advantage of the sudden runs. - Learn to identify High Frequency Trader or Professional Trader setups that precede velocity action.

High Frequency Traders leave a specific and easy-to-recognize footprint on the candlestick chart. This can be an extraordinarily long white candlestick or a gap, and extreme stock Volume. There are often Professional Trader footprints which are more subtle but can also be identified. Professional Traders are careful about entries and often enter incrementally. They tend to precede High Frequency Trader sudden huge moves in price. - Use more of the historical daily chart price action to anticipate future near-term price action.

Stock analysis for optimal stock picks requires more than just looking for a specific candlestick entry, indicator crossover, or setup. Those are good starting basics, but once a Retail Trader has learned these basic beginner skills, they need to start learning the more advanced skills of stock analysis. One of those advanced skills is identifying which of the 9 Stock Market Participant Groups is in control of price at that time. The candlestick chart example above shows many gaps which are called Island Gaps. It is a volatile price action dominated by Professional Traders entering, followed by High Frequency Trader orders that trigger due to the Professional Trader activity. - Finding Stocks to Trade Faster requires learning to recognize the Trendline Patterns and Sideways Candlestick Patterns in the chart.

The amplitude and magnitude of the candlesticks provide excellent information for short-term trading entries and exits. - Identify the Technical Conditions for that stock.

Price formations do not occur by accident. Every price candlestick pattern has intent behind it based on who is controlling price and their intended price direction for that stock. Fundamentalists controlling price create a different look to price action than when Technical Professional Traders are controlling price.

LEARN MORE at TechniTrader.Courses

If you have not yet begun to trade or invest, go to Introduction: Learn How to Trade Stocks – Free Video Lesson to get started.

Learn the steps to trade like a pro with this introductory mini course. You will learn what it takes to create a Professional Trading Plan that can help you achieve your trading goals: How to Create a Professional Trading Plan

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a MetaStock chart, courtesy of Innovative Market Analysis, LLC dba MetaStock

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.