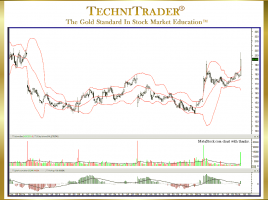

How to Use Bollinger Bands® in MetaStock Charts

Add Stock Volume Indicators for Direction Stock Will Move The Bollinger Bands indicator has been gaining in popularity. This is no surprise, given the changes in the Market Structure and how price behaves with more of the Exchanges, Dark Pool Alternative Trading Systems (ATSs), Electronic Communication Networks (ECNs), and other …