Why Use Bollinger Bands® %B for Swing Trade Entries?

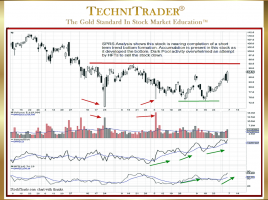

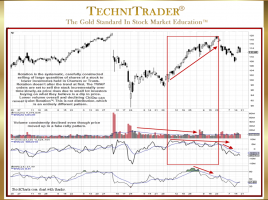

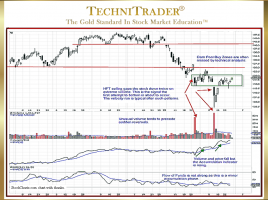

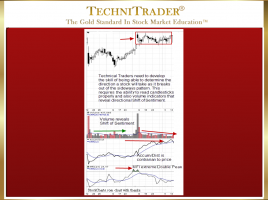

To Customize Trading Style, Preferred Entry Signal, & Lower Entry Risk Bollinger Bands are often used on the price chart itself, and they can be used on indicators as well. However, there are other indicators written by John Bollinger that give Swing and Day Traders an easier way to not …