How to Decode a Candlestick Chart with Doji

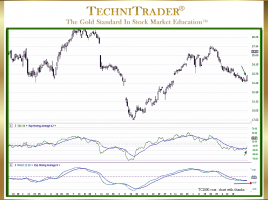

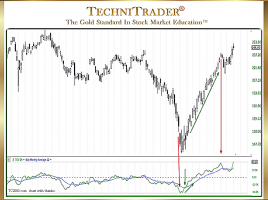

Use Pure Price as Entry & Exit Signals When Candlestick Charts were first introduced to the western markets, everyone using Stock Charts and Technical Analysis relied on indicators more than Bar Charts, which were the most popular charts back then. Bar Charts are much harder to read, give less visual …