Why Use Stock Volume and Quantity Analysis?

To Identify Price Action by Stock Market Participant Groups

Before there were High Frequency Traders (HFTs), Dark Pools, Twilight Pools, and an 80% automated marketplace, the most important indicator was price. Many Retail Traders learned to simply rely upon price action and rarely considered stock volume or quantity analysis.

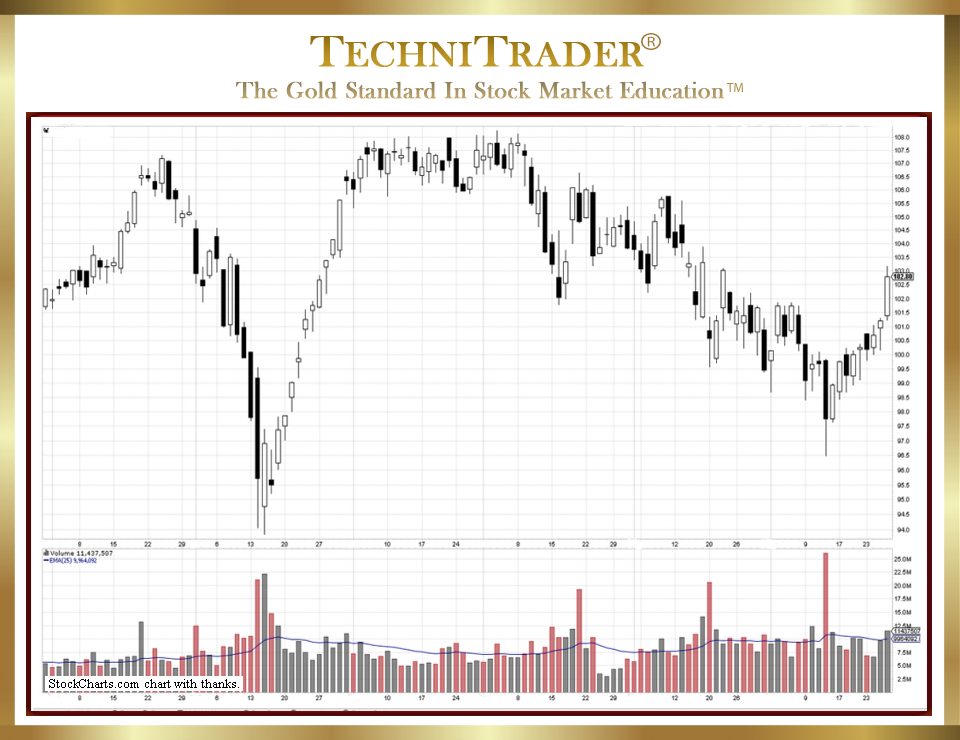

Chart example #1 below has the stock Volume Indicator in the bottom chart window. It is a Daily Chart View, so the stock volume shown is the total number of shares for an entire day.

Huge stock volume spikes are predominantly the effect of High Frequency Trader millisecond transactions firing off at 60,000–90,000 per minute. There will also always be Smaller-Lot Investors, Retail Traders, and some Smaller Funds involved in these huge stock volume surges. However, there will rarely be Dark Pools, as those orders avoid or cease triggering when stock volume surges or price rises speculatively.

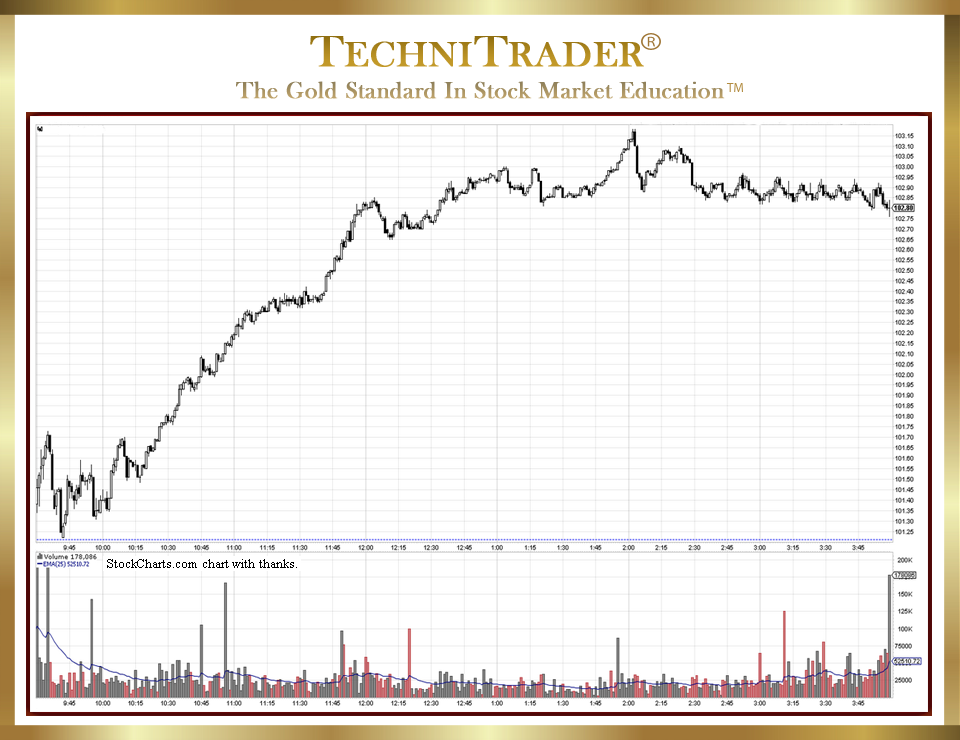

Chart example #2 below is the identical stock chart as chart example #1, but with an INTRADAY VIEW.

As you can see, the first of the day has a huge stock volume spike and price is moving substantially in the first few minutes of the day, selling down rapidly. There are also a few intermittent surges of stock volume. This is because the first few minutes of the day are dominated by High Frequency Trader algorithms that trigger on early-morning news.

Nowadays, with the dramatic changes to the trading world, stock volume and quantity must be analyzed along with price. This fact challenges older strategies; however, the reality is that the most dominant Stock Market Participant Group in the market now has even more complex orders, which give that group the ability to buy giant share lots without disturbing price.

The only aspects of data that reveal giant lots are stock volume and quantity. A giant lot is anywhere from 100,000–500,000 shares. The giant-lot buyers do not want to disturb price or the trend of the stock, as they purchase millions of shares over time.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using StockCharts charts, courtesy of StockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.