How to Position Trade Bottoming Stocks

List of 5 What to Recognize in Candlestick Patterns

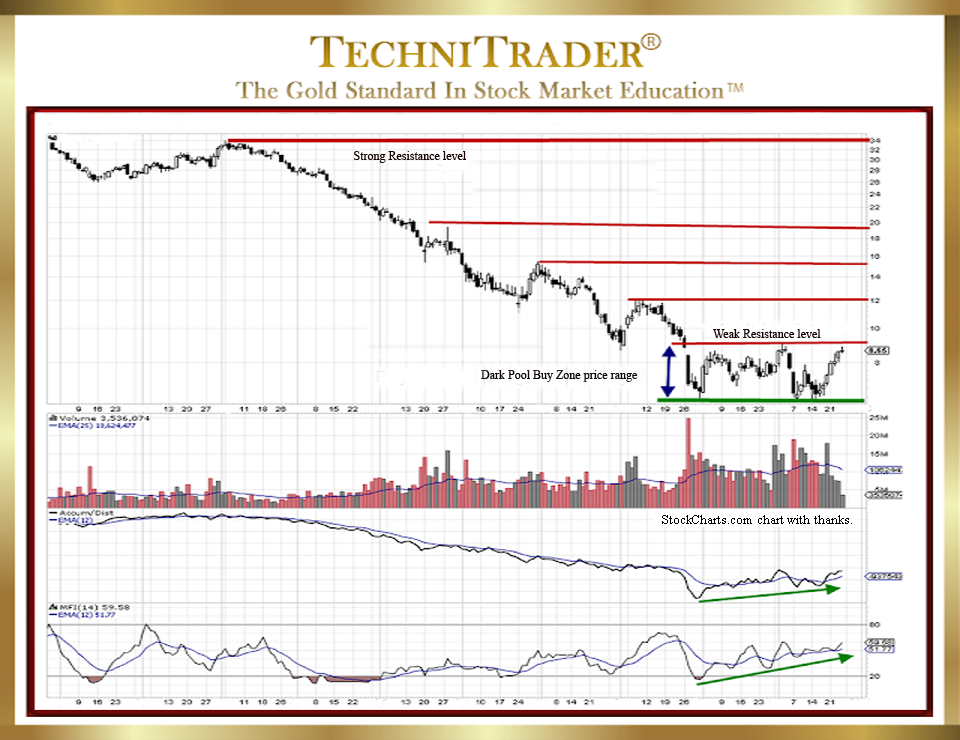

Many traders do not have the time or resources to trade the most well-known Trading Styles, which are Day Trading and Swing Trading. Both of these styles require more time, a higher capital base, and the ability to be trading in the early morning or afternoon while the market is open. The chart example below shows a stock in the early stages of a bottoming formation candlestick pattern, which would be identified for Position Trading.

Position Trading provides an alternative that is actually more lucrative with less time for analysis, and entering the order when it is convenient for you.

Typically, Position Traders are trading with the most reliable Stock Market Participant Group, which is the Buy Side Institutions who are entering stocks with large to giant lots. The hold time is anywhere from a couple of weeks to a couple of months depending upon the Target Gain Potential, which is the resistance that will stall or reverse the trend.

The goal of Position Trading is to find where the Buy Side Institutions are quietly accumulating, still unnoticed by High Frequency Traders (HFTs), Retail Traders, and the Smaller Funds Stock Market Participant Groups. The Buy Side Institutions are experts at hiding their large to giant-lot accumulation using Dark Pools while they are acquiring the millions of shares of stock they intend to buy. Once the word gets out that they have been accumulating, price can move with momentum, often completing a bottom suddenly.

Position Traders need to recognize the following in candlestick patterns:

1. Dark Pool Quiet Accumulation

This is a tighter sideways candlestick pattern action within a Dark Pool Buy Zone™ range which is narrow and precise price action contained within a set price range. Accumulation triggers their Time Weighted Average Price (TWAP) orders as the stock drops into the Buy Zone. The buying triggers automatically cease if the stock rises or falls out of the Dark Pool Buy Zone.

2. Bottom Completions

Most bottoms take time to complete due to the methods Dark Pools use to acquire stock over many weeks to several months. Being able to identify a completed bottom candlestick pattern is crucial to a Position Trader entering before price moves out of the Dark Pool Buy Zone, but not too soon when the stock will continue moving up and down within that range.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a StockCharts chart, courtesy of StockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.