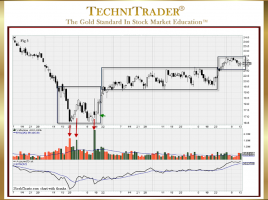

How to Exit Stocks at Correct Technical Level

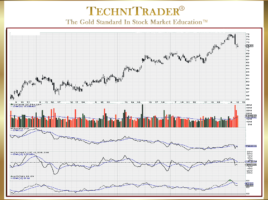

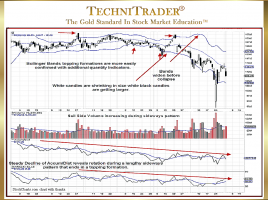

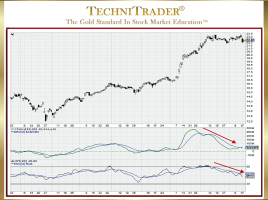

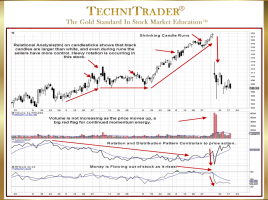

Identify Resistance Where Professional Traders Would Start Taking Profits Most of the time, Retail Traders are focused on finding stocks to trade. However, they spend scant time on assessing risk, proper stop loss placement, trailing profit stops, and determining when to exit the trade, especially as a stock goes ballistic. …