Where Is Support for Swing Trading Style Runs?

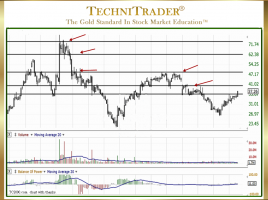

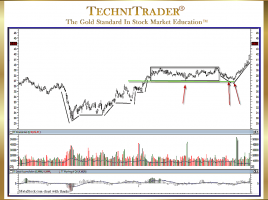

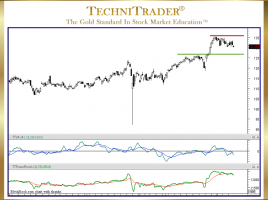

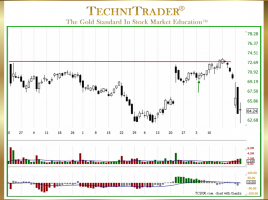

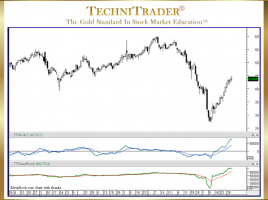

Stronger and Weaker Support Explained Support and Resistance are often areas of Technical Analysis that are not fully understood. Swing Trading includes Momentum Runs, Velocity Runs, Volatile Runs, and Intraday Swing-Style Runs, each of which have their own Support and Resistance. The chart example below had a Standard Swing Run …