Why Trade Small Cap Stocks?

Trade with the Professional Traders for Higher Point Gain Potential

Many Retail Technical Traders are still unaware of a gold mine of trading opportunities that can yield higher profits due to wider spreads. The Securities and Exchange Commission (SEC) started a test pilot program for small cap stocks a couple of years ago to widen the spread to a minimum of 5 cents. The goal was to provide more liquidity from Professional Traders who require a wider spread to reach their point gain profit goals.

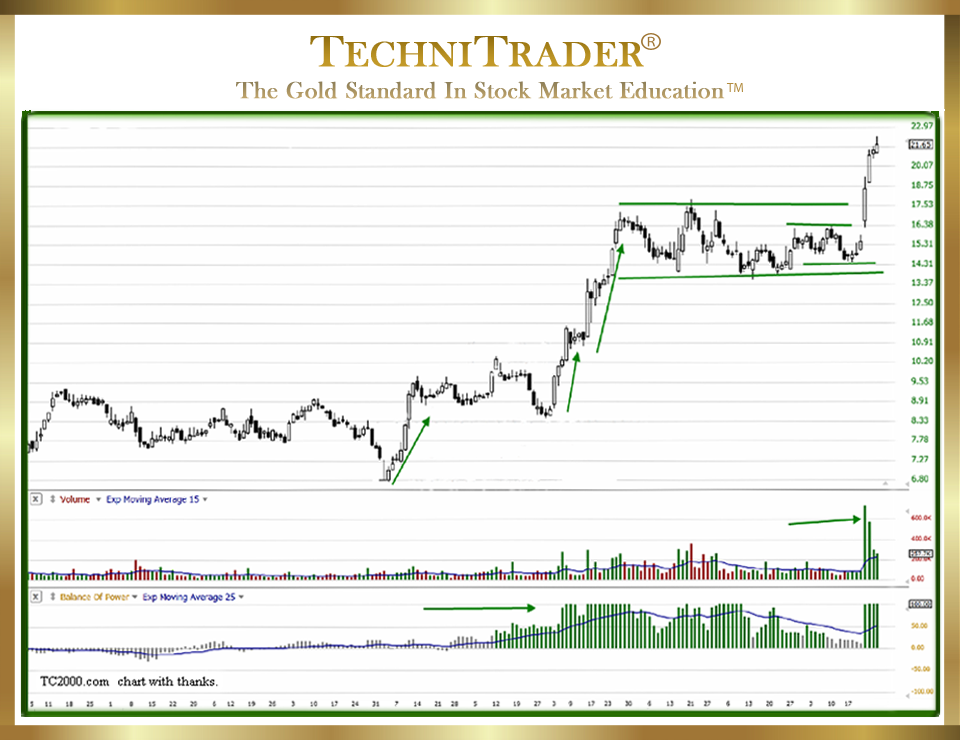

The chart below is an example of a small cap stock that is doing significantly better under the new ruling for wider spreads. The stock has moved up steadily, and each run has the telltale footprint of active Professional Traders trading short-term.

The last run formed after a compression pattern that resulted in a High Frequency Traders (HFTs) initiated run that netted a nice profit for Retail Swing Traders as well.

TC2000.com Users also benefit by having Balance of Power, which reveals the large-lot trading activity before the HFT triggers cause the runs upward. In this chart, heavy concentrations of Professional Traders and Smaller Funds provide an easy-to-identify compression-style entry for a quick swing trade of 5+ points of profit in 4 days.

LEARN MORE at TechniTrader.com

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a TC2000 chart, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2026 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.