5 Techniques Find Stocks Faster

Tips for Investing and Trading

One of the daunting tasks for many new or novice investors and retail traders is finding stocks to invest in long term or to trade. Right now, there are over 9,500 different listed stocks, Over-the-Counter (OTC) stocks, and Exchange-Traded Funds (ETFs) that you could buy. That’s way too many to study.

Oftentimes, this is such a huge hurdle that people simply do what seems easy and simple. They go to a recommendation service, read what a famous investment guru is “buying”, use a news event, or a stock that a friend or co-worker talks about. New investors and beginning traders may just give up and choose one of the big name stocks, assuming that a company that is well known must have a good stock. Nothing could be further from the truth. Even big companies can have weak stocks that are falling in price, or are stuck in a sideways price range that has not changed in many years.

All of the ways mentioned above are the WORST possible ways to find great stocks to invest or trade. Using any of these common approaches to finding a stock to buy, can and do cause MOST of the losses new or novice investors and traders have after a stock purchase.

In order to learn “How to Invest for Consistent Success™” in the stock market, use reliable methods for finding stocks that do not take a lot of time to learn or use.

Here are 5 Basic Techniques for finding great stock picks for investing long-term or to trade shorter-term.

- Learn to read stock charts.

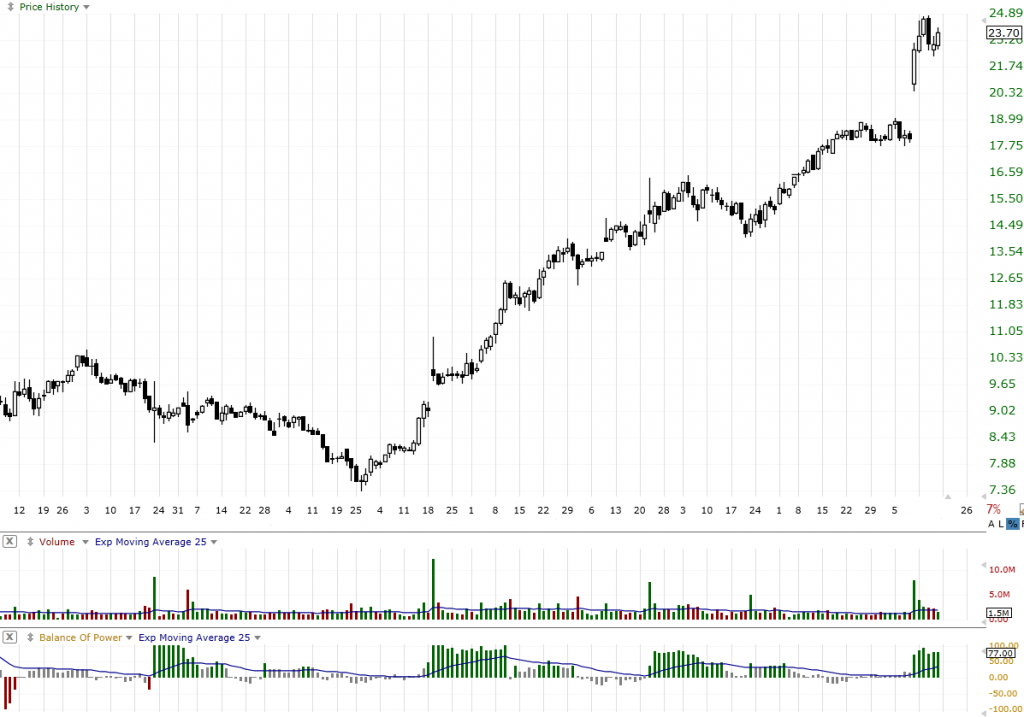

This may seem like an obvious solution but most new and novice investors and traders do not really know how to properly read a stock chart. They have read a few things, watched a webinar or two, or have attended a weekend seminar. But if you really want to be successful, learn how to read a stock chart as easily as you read a book. It may take a little time, but the financial rewards are far more than you can imagine.

- Create Scans based on personal criteria.

Scans in charting software can search all 9,500 stocks and instruments, and bring up just the very best for how you want to trade. An example of a terrific scan would be one that has a specific price range. Let’s say you want to only trade stocks between the ranges of $10–$20 this immediately will lower the 9,500 stocks to around 1,200. You should have at least 3 criteria but no more than 5 if you are a beginner. Your scan should pull up around 40–100 stocks that are based on your criteria for investing or trading.

- Use Candlestick buy signals.

Now that you have only 40–100 stocks to look at, you have a very manageable list. Now choose just one candlestick chart buy signal such as the Springboard Pattern, an easy to learn pattern for beginners which has lower risk and is an easy method of computing the entry price. It is very quick and easy to click through a few charts to find the best Candlestick Patterns, and then put those stocks in a Watchlist.  4. Use Indicators to confirm the strength of the Candlestick entry signal.

4. Use Indicators to confirm the strength of the Candlestick entry signal.

In chart analysis the Candlestick Pattern is part one and confirming using Indicators is part two. This is also easy to do and takes only a quick glance for a “yes” or “no” for analysis.

- Select only the best charts and delete all the rest.

Risk to Reward or profit potential analysis will tell you immediately if the stock is a good stock pick candidate.

These 5 steps make finding great stocks to buy fast, easy, and reliable.

These 5 steps make finding great stocks to buy fast, easy, and reliable.

Summary

What’s next? Learn how to select stocks using this 5-step process. Sure, you are going to have to commit some time to learning these steps and practicing, but you will earn significantly higher return on your investments or short-term trading profits.

I invite you to visit my website at www.TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using TC2000 charts, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.

Disclaimer: All statements, whether expressed verbally or in writing are the opinions of TechniTrader its instructors and or employees, and are not to be construed as anything more than an opinion. Readers are responsible for making their own choices and decisions regarding all purchases or sales of stocks or issues. TechniTrader is not a broker or an investment advisor; it is strictly an educational service.