5 Techniques Find Stocks Faster

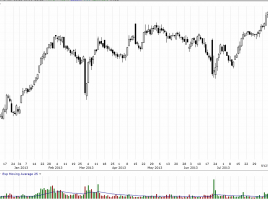

Tips for Investing and Trading One of the daunting tasks for many new or novice investors and retail traders is finding stocks to invest in long term or to trade. Right now, there are over 9,500 different listed stocks, Over-the-Counter (OTC) stocks, and Exchange-Traded Funds (ETFs) that you could buy. …