Why Track Dark Pools with TC2000 Balance of Power Indicator?

For Swing Trading Momentum Runs Out of Bottoms

You can learn to identify setups for Swing Trading momentum runs by focusing on price trends and indicators that reveal Dark Pool Quiet Accumulation. TC2000 Users have a huge advantage over other Retail Traders. They have access to custom indicators designed specifically to track and reveal Dark Pool Quiet Accumulation and Professional Trader activity, which results in sudden momentum runs created by High Frequency Trading.

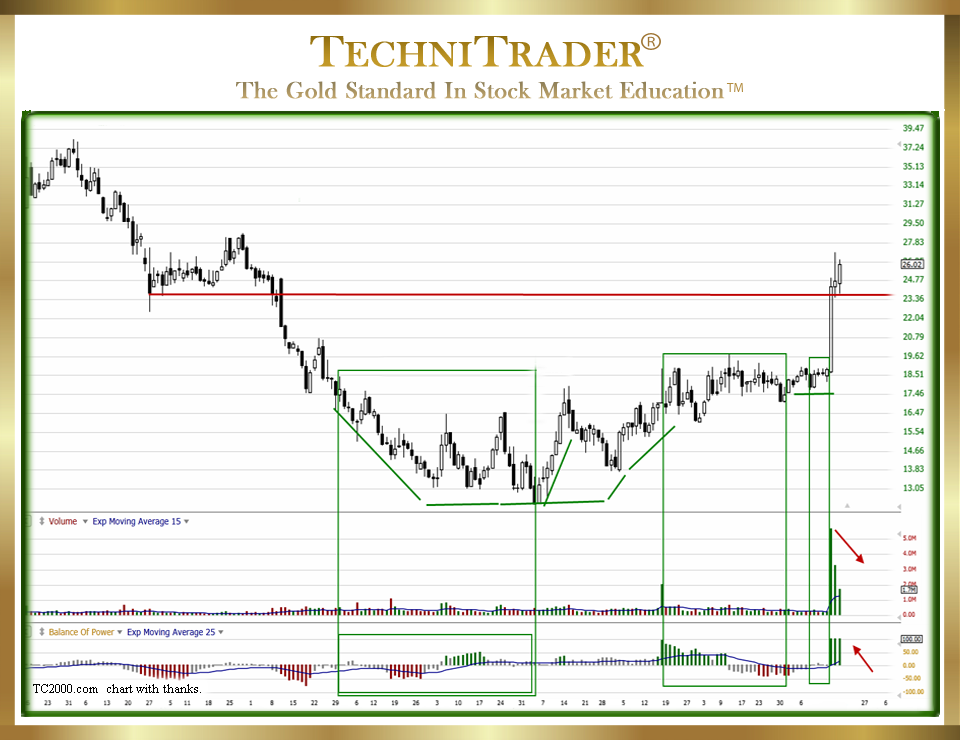

Above is a candlestick chart example of a Small Cap Stock with 37 million outstanding shares. The smaller the number of the outstanding shares, the more likely a liquidity draw by Dark Pools will trigger huge runs and gaps. Therefore, identifying the Dark Pool Quiet Accumulation is a key element to getting into the stock ahead of the High Frequency Trader (HFT) runs.

Worden’s Balance of Power (BOP) indicator reveals the Quiet Accumulation mode by Dark Pools early in this bottoming formation. This is a crucial aspect of entering the stock ahead of the inevitable momentum run or one-day High Frequency Trader gain or gap.

Momentum Trading can be more fun and less work when you employ the Balance of Power indicator written by Don Worden.

This indicator has become better at revealing Dark Pool Quiet Accumulation as the popularity of Alternative Trading Systems (ATSs) continues to increase. More and more Buy Side Institutions, including some Smaller Funds, are using Dark Pool venues more than ever before.

Also, the 5-cent spread for Small Caps is creating plenty of momentum activity for Small Cap stock trading.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a TC2000 chart, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.