Why Recognize MACD Contrarian Indicator Patterns?

Sideways Candlestick Pattern Breakout Direction

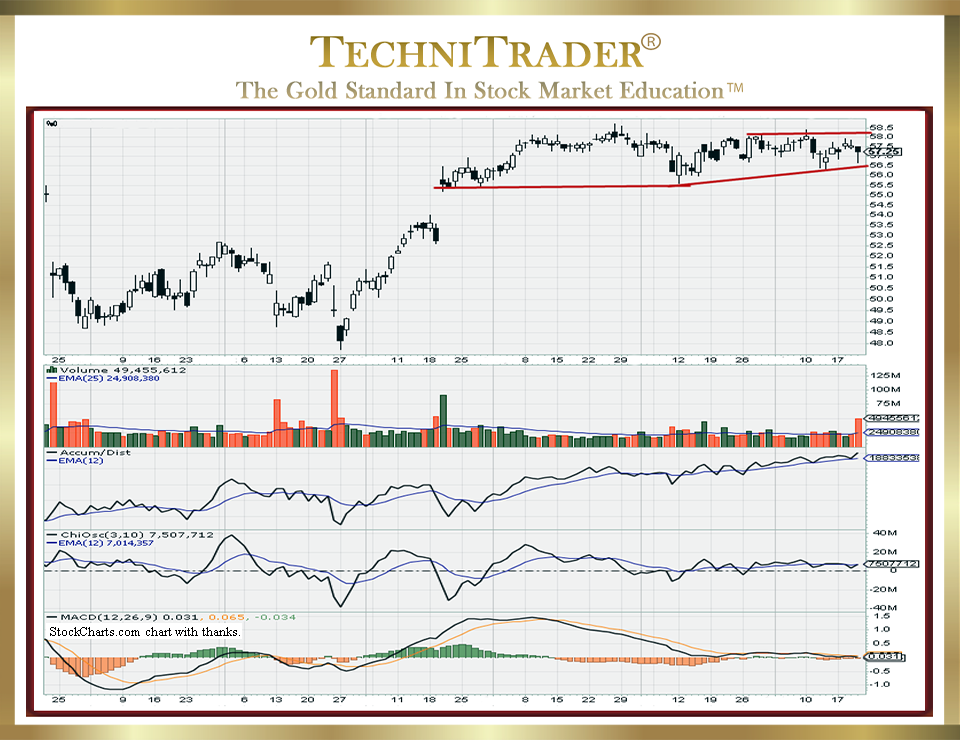

Oftentimes, traders may be confused with conflicting indicator patterns. Contrarian patterns between indicators and between Price and stock Volume-based Indicators are very common these days. In the stock chart example below, the stock gapped up on earnings news and shifted to a sideways candlestick pattern that compressed. Then, it slipped slightly but quickly rebounded, and it began another compression pattern. See the stock chart below.

Comparative analysis and Relational Technical Analysis™ are required for a stock chart like this; otherwise, the interpretation of just candlesticks or just a couple of indicators will be incorrect.

Understanding what the contrarian indicator patterns represent in terms of near-term price action is crucial for higher profitability and strong stock picks in the current Stock Market.

A common area of difficulty for most traders is the various sideways candlestick patterns that are becoming more and more common in the new Market Structure, which is reshaping how Retail Traders will trade over the next decade.

There are massive changes going on behind the scenes of the Stock Market that only Professional Traders are privileged to know. This leaves most Retail Traders in the dark and can often create more risk and lower profits for them.

Short-term trading analysis is entirely different than long-term investing analysis. The training in this article is for short-term trading and not long-term investing.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a StockCharts chart, courtesy of StockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.