Why Is There Burgeoning Success of Position Trading?

It Is a Reliable Low-Risk Entry Trading Style

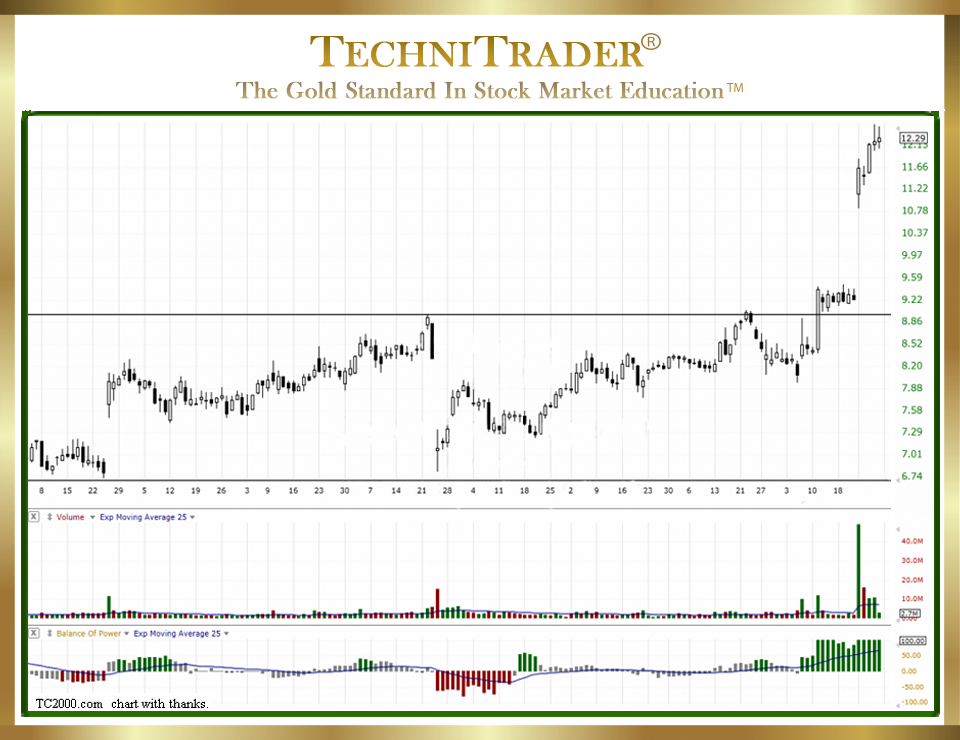

Position Trading is a newer Trading Style that most people haven’t heard about, unless they are a TechniTrader Student. I developed this Trading Style for choppy Sideways Market Conditions. More and more of the Large and Giant Funds Managers have moved their buying and selling away from the Stock and Options Exchanges into Dark Pools, Twilight Pools, Electronic Communication Networks (ECNs), and other “LIT” market venues. This has slowly changed what we see in Technical Analysis patterns over the past decade, which now allows for a burgeoning success of Position Trading.

Stocks spend more time in various sideways candlestick patterns from tight Consolidations to medium-width and very uniform Platform sideways price action to the very wide Trading Range sideways action. This is due to the numerous new stock order types designed and used exclusively by the Buy Side Institutions and the Sell Side Institutions that use the Dark Pools and Twilight Pools for their large-lot and giant-lot transactions.

ALL stock trades MUST be cleared via a clearinghouse. Consequently, every order, whether it is a Dark Pool, a High Frequency Trader (HFT) millisecond trade, or a retail trade, is recorded with transfer of title issued, and then this data is processed and sent out to the Financial Data Feed Providers such as Reuters or Morningstar.

These companies then sell the data to charting software companies and other vendors for both the retail side and the professional side. So, every order is recorded no matter where the order was executed.

With the Large and Giant Funds using controlled and bracketed new stock order types on Dark Pools and Twilight Pools, their footprint has become extremely easy to recognize on a stock chart. Typically, these giant-lot investors and traders prefer NOT to disturb price. They do not receive any advantage over retail or other venues, but adhere to the current National Best Bid and Offer (NBBO) pricing structure. However, they are using specialized orders that avoid huge stock volume spikes of the High Frequency Traders and focus on specific price buy entries and paused or timed entries. These allow the giant-lot orders to not disturb price or stock volume and provide for a steady and consistent accumulation or distribution for the Giant Fund for that stock, index, or option.

Retail Traders who are busy with a full-time job and have very little time to trade stocks can take advantage of the burgeoning success of Position Trading because it offers an ultimate solution for the following:

- Minimum time and effort requirements

- High Return on Investment (ROI) for a stock held for a few weeks to a few months

- Reliable and lower-risk entries

- A very forgiving entry for beginners and novices

- An obvious exit target point that allows for simple adjustments to Trailing Profit Stops and Exit Strategies

Position Trading is by far the most profitable of all the short-term Trading Styles and requires far less capital and risk tolerance as well as experience.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a TC2000 chart, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2015–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.