How to Decode a Candlestick Chart with Doji

Use Pure Price as Entry & Exit Signals

When Candlestick Charts were first introduced to the western markets, everyone using Stock Charts and Technical Analysis relied on indicators more than Bar Charts, which were the most popular charts back then. Bar Charts are much harder to read, give less visual data, and take longer to interpret. Candlestick Charts were instantly popular because they made reading price fast and simple.

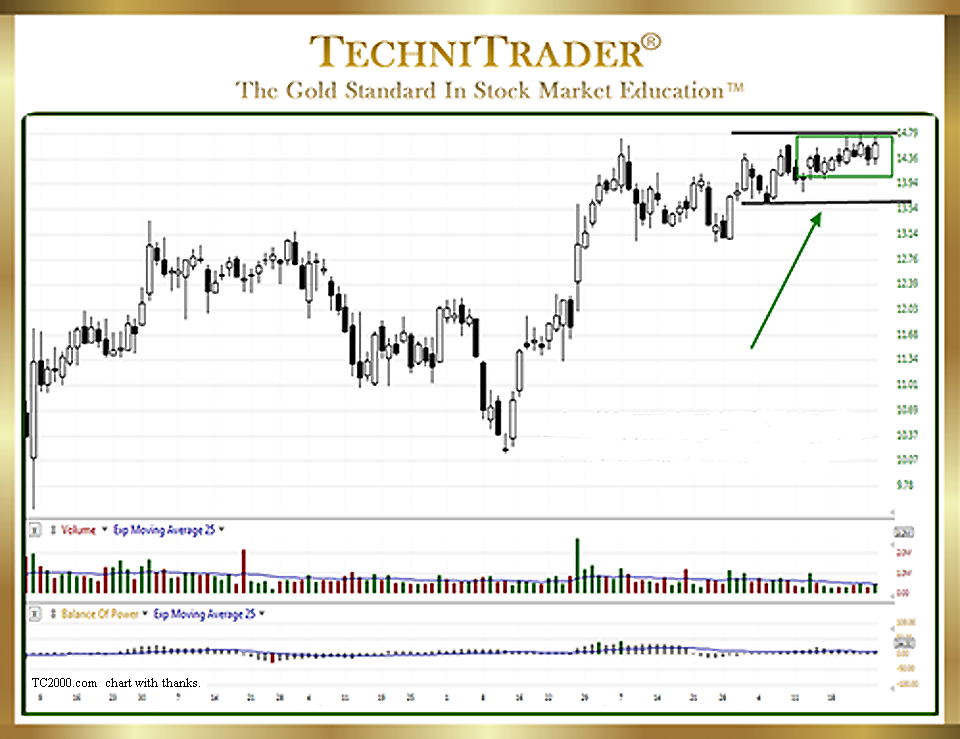

See the candlestick chart example below with a series of Doji, which indicates Dark Pools controlling price.

In the beginning, candlesticks were assumed to be the confirming indicator making pure price subordinate to indicators such as MACD and Stochastic, which are both very popular indicators. However, using candlesticks as the entry signal rather than just confirming a continuation of the trend or a reversal of the trend enables traders to use pure price as their entry and exit signals.

Spatial Pattern Recognition Skills™ are something most traders do not have, and need to develop. It takes a while to learn how to read candlesticks as quickly and as easily as you are reading this text, but when you can do so, it opens up a world of information about why price is moving as it is and how it will move next.

Especially during Trading Range Market Conditions, having keen Spatial Pattern Recognition Skills is imperative. Otherwise, the markets seem merely volatile, unpredictable, and confusing.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a TC2000 chart, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.