What Are 5 Tips for Sell Short Success?

New Topping Candlestick Patterns List and New Entries & Exits

Selling Short is a Trading Style few Retail Traders and Technical Traders use even during major Bear Markets. The reason is because it is often far more challenging to understand the technical patterns of the downtrend which include 5 Tips for Sell Short Success.

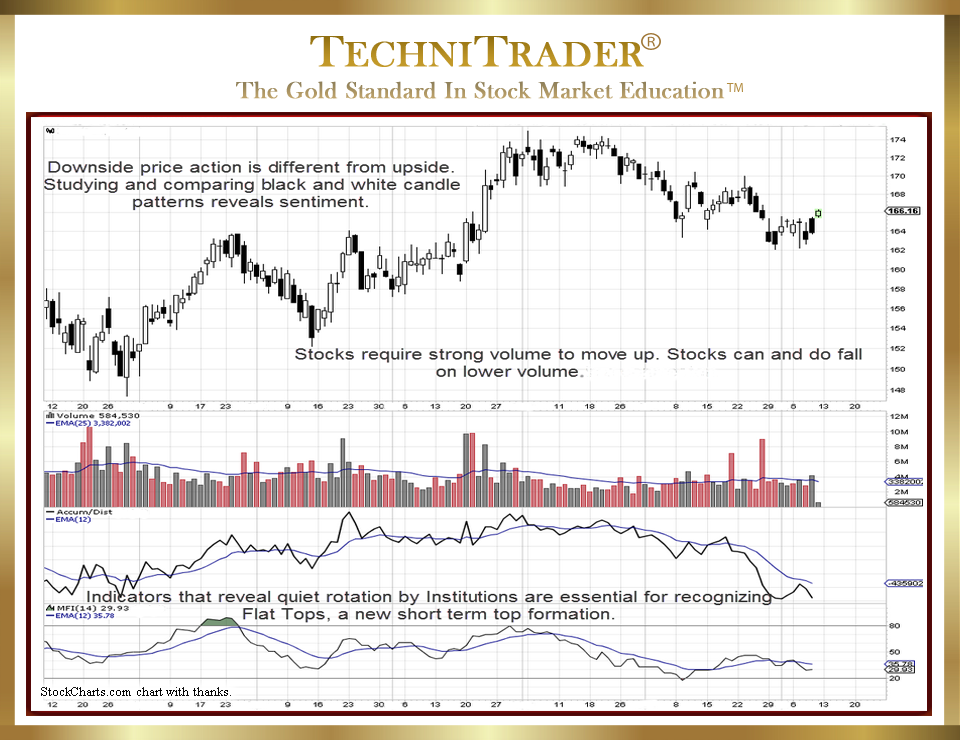

See the candlestick chart example below.

How stocks move down, where support levels create bounces or rallies, and how to know when to enter and when to exit a Sell Short Trade for maximum profits is a challenge for most traders.

Here are 5 Tips for Sell Short Success:

1. Learn to recognize the new Topping Candlestick Patterns, which are:

a. Flat Tops

b. Flat Shoulders (a variation of Head & Shoulders)

c. Rounding Tops

d. Sheer Cliff Tops

e. Ripple Tops

Topping action has changed dramatically in recent years due to Buy Side Institutions now using Dark Pools for their orders, High Frequency Trader (HFT) activity, and the return of the human Professional Trader to trading floors. In addition, there have been changes to regulations for the Buy Side Institutions and Sell Side Institutions, new Stock Derivatives, and the fracturing of the Market Venues for processing orders.

These newer tops are not in the older Technical Analysis books because they were not occurring in markets before 2010. These new tops are often mistaken as continuation patterns rather than a top, which puts traders at a higher risk of whipsaw trades.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a StockCharts chart, courtesy of StockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.