What Is the Power in Platform Candlestick Patterns?

Buy Side Institutions Buying in Dark Pools Prior to Runs

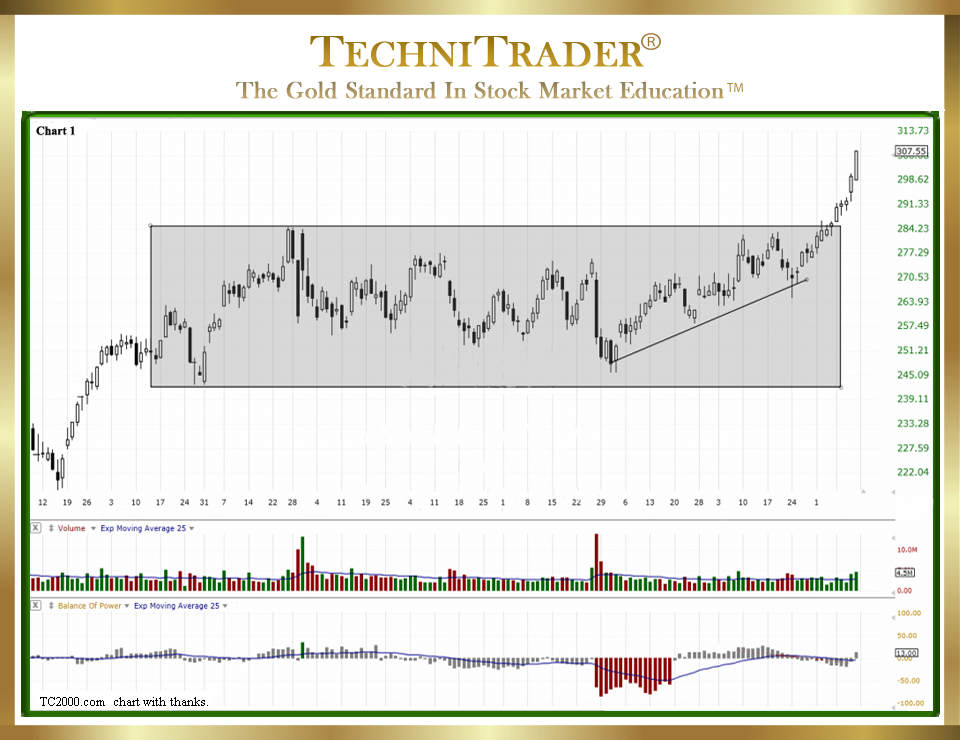

The “Platform Candlestick Pattern” is a relatively new sideways candlestick pattern that is becoming more and more prevalent as the Dark Pools’ activity increases. Dark Pools are Alternative Trading System (ATS) venues that transact giant-lot orders off of the Exchanges. This is legal and actually benefits Mutual Fund Investors and Pension Fund owners. The Platform is always a range, but unlike a true Trading Range, the Platform Candlestick Pattern tends to have much more consistency to its highs and lows. See candlestick chart example #1 below.

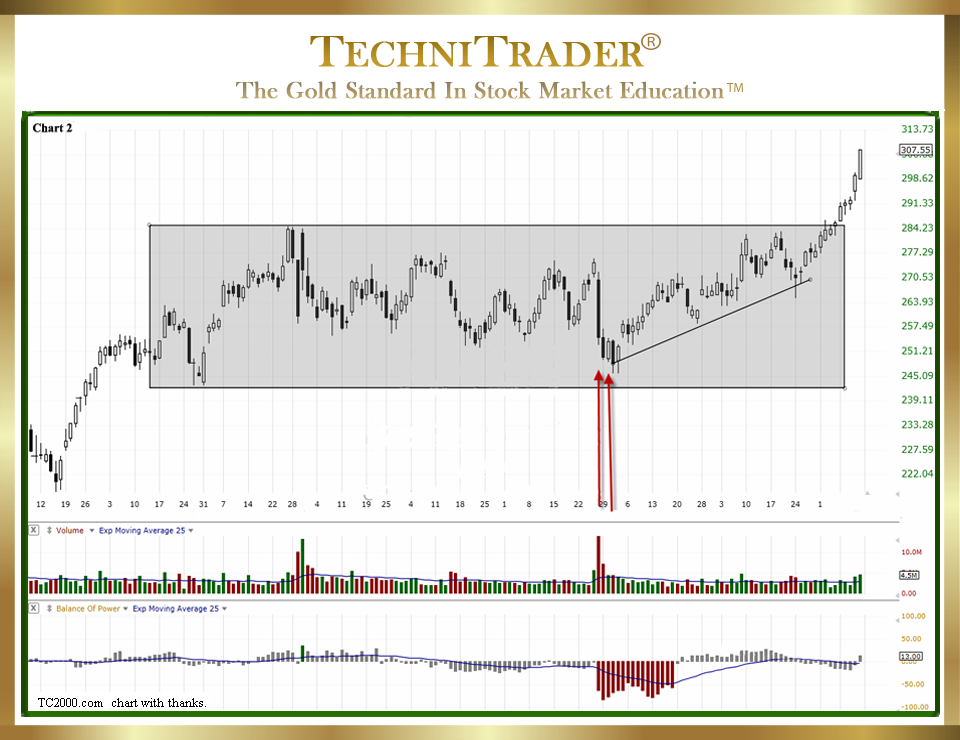

This high and low price range is seldom disrupted, but it can be mostly by High Frequency Traders (HFTs) who do not recognize the footprint of their most sought-after Stock Market Participant Group. In not recognizing the footprint of the giant-lot institutions who are mostly Buy Side Institutions, the High Frequency Traders trigger a brief sell-off. See the two red arrows in candlestick chart example #2 below.

The attempt is quickly overwhelmed, as the giant Buy Side Institutions using Dark Pools have orders that trigger off the exchanges when price drops to the low of their price range. As the giant institutions buy, their dominance moves price up within the range. Eventually, Professional Traders, Smaller Funds, and sometimes High Frequency Traders will drive price up beyond the Dark Pools’ original high price for their buying.

The Platform Candlestick Pattern develops on stock charts because giant-lot Buy Side Institutions and sometimes giant-lot Sell Side Institutions decide they want to purchase stock of a company. Let’s say that they wish to purchase 50 million shares. They can’t buy all the shares at once, as that would cause the stock to spike in price due to a sudden demand, and perhaps not enough shares being sold would further aggravate shortages of the stock to push price higher. So, they use Dark Pools with a bracketed order system.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using TC2000 charts, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.