What Is Relational Technical Analysis™ of Platform Candlestick Patterns?

Use Stock Volume Indicators to Reveal Accumulation Patterns

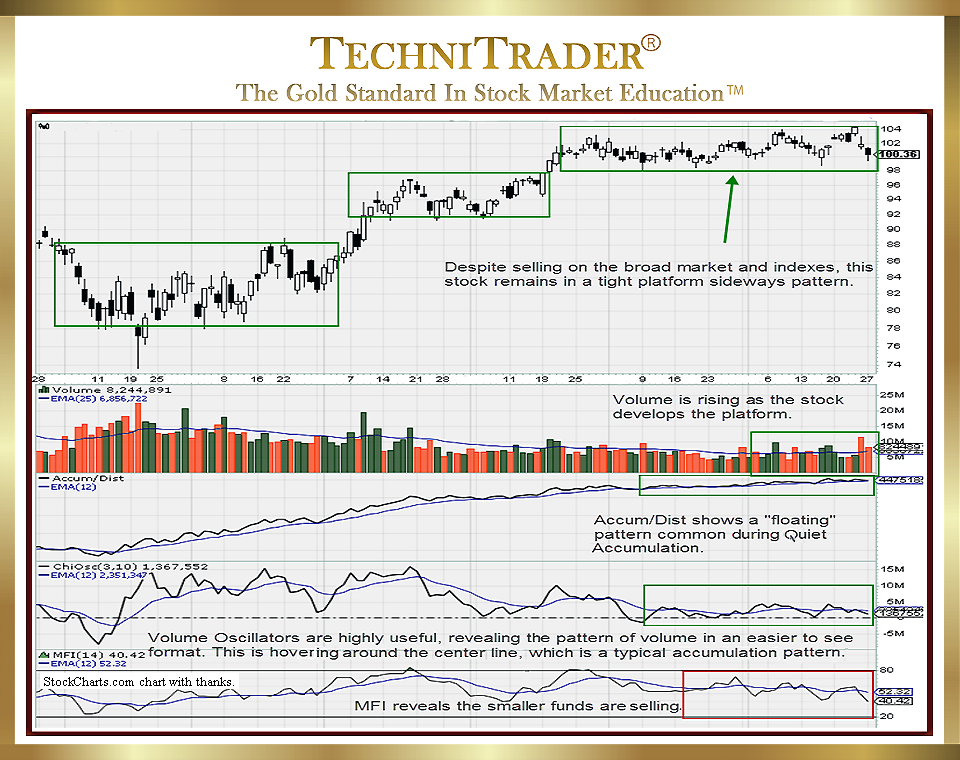

Relational Technical Analysis embodies more Technical Analysis and often Fundamental Analysis to derive a clearer understanding of the behavior of price. A Platform Candlestick Pattern is a very specific type of sideways price action which only forms when Buy Side Institutions using Dark Pools are accumulating a stock. It forms due to the type of orders these giant-lot investors use. They use a bracketed stock order type available only on Dark Pool venues, and thus price can be controlled in a precise manner.

See the candlestick chart example below.

LEARN MORE at TechniTrader.Courses

The Platform Candlestick Pattern is typically 10%–12% in width or magnitude. The runs within the Platform are too small and brief for good Swing Trading; however, oftentimes less informed Retail Traders will try to Swing Trade these intra-range runs with results of whipsaw action.

The Dark Pool bracketed orders are automated, but they are not High Frequency Trading Firm (HFT) orders. The sideways action in itself will not reveal whether this is Dark Pool Quiet Accumulation or Dark Pool Quiet Rotation™ by the giant Buy Side Institutions. Indicators other than those that use just price and time are required for Relational Technical Analysis of a Platform Candlestick Pattern.

Relational Technical Analysis is needed in order to determine if this is Dark Pool Quiet Accumulation, which is the buying of stock slowly over many weeks to months, or Dark Pool Quiet Rotation, which is the selling of stock slowly over many weeks to months.

This is to lower inventory of a long-term held stock. “Dark Pool Quiet Distribution” is the term used for the sudden selling of shares by institutions to meet redemption demands.

Stock Volume and Accumulation/Distribution Indicators, stock Volume Oscillators such as ChiOsc, and Flow of Funds Indicators such as Money Flow Index (MFI) will reveal whether buying or selling is dominant.

The stock above does have a Dark Pool Quiet Accumulation candlestick pattern; however, it is likely to continue moving within the Platform price range for a while due to the heavy Smaller Funds selling against the giant Buy Side Institutions quietly buying.

LEARN MORE at TechniTrader.Courses

One fact that often eludes stock traders who have not learned Relational Technical Analysis is the fact that the giant Buy Side Institutions using Dark Pools buy in giant share lots of 100,000–500,000 over extended periods of time but do not move price outside of their buy zone.

The Securities and Exchange Commission (SEC) MIDAS has been tracking these giant-lot orders for several years. The SEC has determined that the giant Buy Side Institutions using the Dark Pools do not gain any price advantage. Their orders tend to execute in the middle of the National Best Bid and Offer (NBBO). In addition, the average time to fill the giant-lot orders is 10 minutes because often the liquidity must come from several venues.

Although the Dark Pools hide their activity to avoid front-running from High Frequency Traders, the giant Buy Side Institutions leave footprints that are easily seen on a stock chart.

Relational Technical Analysis is more sophisticated than standard Technical Analysis, and it takes some time to learn in order to be able to interpret quickly and accurately. However, the benefits of Relational Technical Analysis of a Platform Candlestick Pattern are earlier entries, lower risk, and higher profits.

Platforms have a very specific price-controlled range during their formation. Once the Dark Pool Quiet Accumulation ends, the stock will break out of the Platform, often with momentum energy.

When the giant Buy Side Institutions have filled their inventory requirements, word leaks out to others in the market that they have been accumulating a stock. This initiates buying action by Professional Traders followed by High Frequency Traders, which are then chased by Smaller Funds and Retail Traders. All of these other groups tend to move price speculatively.

Summary

Understanding why price is behaving in a certain manner is important if you wish to earn higher profits from short-term trading. The Platform is the ideal candlestick pattern for Position Trading. The term “Position Trading” is defined as a few weeks to several weeks hold time during the time period when the stock is building Platforms while moving up in a Moderately Trending pattern.

LEARN MORE at TechniTrader.Courses

If you have not yet begun to trade or invest, go to Introduction: Learn How to Trade Stocks – Free Video Lesson to get started.

Learn the steps to trade like a pro with this introductory mini course. You will learn what it takes to create a Professional Trading Plan that can help you achieve your trading goals: How to Create a Professional Trading Plan

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a StockCharts chart, courtesy of StockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.