How to Use Balance of Power for Early Entry into Stocks

Shift of Sentiment™ Signals Momentum Energy Is About to Occur

TC2000.com Users have a huge advantage over other Retail Traders as they have access to 3 of the most powerful indicators for the markets today which are automated with multi-venues for Stocks and Options. The complexity of the modern markets today challenges Retail Traders more than ever before. These challenges have increased exponentially since the advent of Retail Trading in the 1990s when Retail Brokers made it possible for the average person to trade short-term.

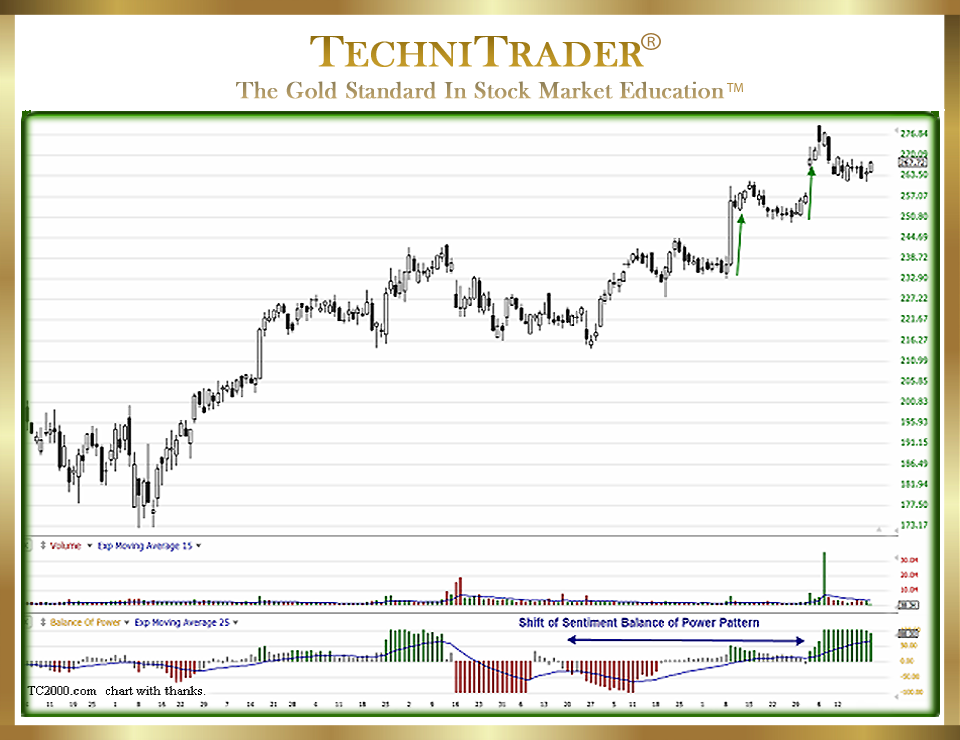

The candlestick chart example below shows the Balance of Power (BOP) indicator “Shift of Sentiment”, which signals that momentum energy is about to occur.

LEARN MORE at TechniTrader.Courses

This is one of many new signals that this indicator provides. These signals (especially the Shift of Sentiment) LEAD price, or in other words, they reveal that the Balance of Power indicator pattern forming is prior to a sudden momentum run.

TC2000.com proprietary indicators offer the ability to detect Dark Pool Buy Zones™ and preset patterns for High Frequency Trader (HFT) gaps, and also Professional Traders’ footprints. However, it requires understanding these stock indicators, how they work, and what patterns indicate which Stock Market Participant Group is in control of price.

LEARN MORE at TechniTrader.Courses

Changes to trading venues, new professional stock order types, and new routing systems have altered how Balance of Power MUST be interpreted. Behind every pattern is the key to unlocking WHO controls price. When you know it is a Dark Pool Buy Zone, then you know how price will behave in the near term. When it is Professional Traders who are showing up in the Balance of Power indicator bars, then price moves differently. Each Stock Market Participant Group has their own unique Balance of Power pattern.

Recognizing and interpreting Balance of Power with a Shift of Sentiment is just one of many critical patterns all TC2000.com Users need to learn. The reason why is because Balance of Power is one of the rare indicators that can actually track and disseminate large-lot activity versus small-lot activity. When large lots are active, it means the giant Buy Side Institutions are accumulating shares of stock in Dark Pools. After they have accumulated all they want, then High Frequency Traders and Professional Traders discover the liquidity draw. It is their buying that creates momentum energy after the liquidity draw.

Summary

Learning to use Balance of Power is fun and easy. It is just a matter of learning the new candlestick patterns that form in the modern automated market.

LEARN MORE at TechniTrader.Courses

If you have not yet begun to trade or invest, go to Introduction: Learn How to Trade Stocks – Free Video Lesson to get started.

Learn the steps to trade like a pro with this introductory mini course. You will learn what it takes to create a Professional Trading Plan that can help you achieve your trading goals: How to Create a Professional Trading Plan

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a TC2000 chart, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.