Why Use Balance of Power to Find Dark Pools?

For Identifying Stocks Poised for Momentum Runs

Balance of Power (BOP) is an extremely rare and unique indicator. Its origins come from the professional side of the market. It is designed to separate out large-lot activity from small-lot activity. This kind of stock volume aka quantity analysis on the tick-by-tick scale is not available on the retail side in any of the popular indicators most Retail Traders learn to use.

LEARN MORE at TechniTrader.Courses

Being able to easily detect whether the large lots are selling or buying a stock versus the small lots buying or selling is a key element for finding excellent momentum action BEFORE it happens. Sure, most Retail Traders wait for a MACD crossover signal, but by then the run has been underway for a day to a few days and all that extra profit is lost.

When markets have low volatility, using the Balance of Power indicator is the only way to find the Dark Pool Quiet Accumulation patterns that precede momentum action. Professional Traders can detect the liquidity draw as the Dark Pools buy or sell large quantities of shares while hidden in off-exchange trading venues.

Once a stock has gapped often hugely, the gains of that momentum run are limited at best. Entering before a huge gap should be the goal. Balance of Power provides the data needed to let you know when a stock is poised for momentum action.

How the Balance of Power Indicator Works

Balance of Power is not your everyday indicator. Most indicator formulas are simple and take less space than the length of this sentence. Balance of Power is 3.5 pages of formula and is highly complex in the way it distinguishes large lots from small lots. When there are more of the large lots than small lots, the Balance of Power shifts to that side, up or down. For instance, more demand on the buy side creates a liquidity draw on the Bid, causing prices to rise as demand is much higher due to large lots buying. Price then moves up.

Now, with complex automated and bracketed stock order types used by Professional Traders in Dark Pools, price is controlled while they are buying. This means price is not yet moving even while large lots are increasing the demand side of the transaction. This builds up energy and momentum before the stock price moves. Identifying this accumulation is impossible with MACD. This is because it is a price moving average indicator, and MACD can’t turn up UNTIL price moves up above the moving average.

LEARN MORE at TechniTrader.Courses

Balance of Power reveals the large-lot buying pressure well before the stock price moves up because large lots control their entry price to the penny or half penny. This type of control increases the energy on the demand for the stock, creating even more powerful momentum action once the large lots conclude their buying and inform the Smaller Funds that they have been accumulating this stock.

The combination of High Frequency Traders (HFTs) triggering, Professional Traders buying to create momentum, and Smaller Funds buying with Volume Weighted Average Price (VWAP) orders triggering on the surge of stock volume caused by High Frequency Traders creates huge gaps and runs that net very high profits.

ONLY Balance of Power can show the Shift of Sentiment™, which is easy to read and see BEFORE price moves.

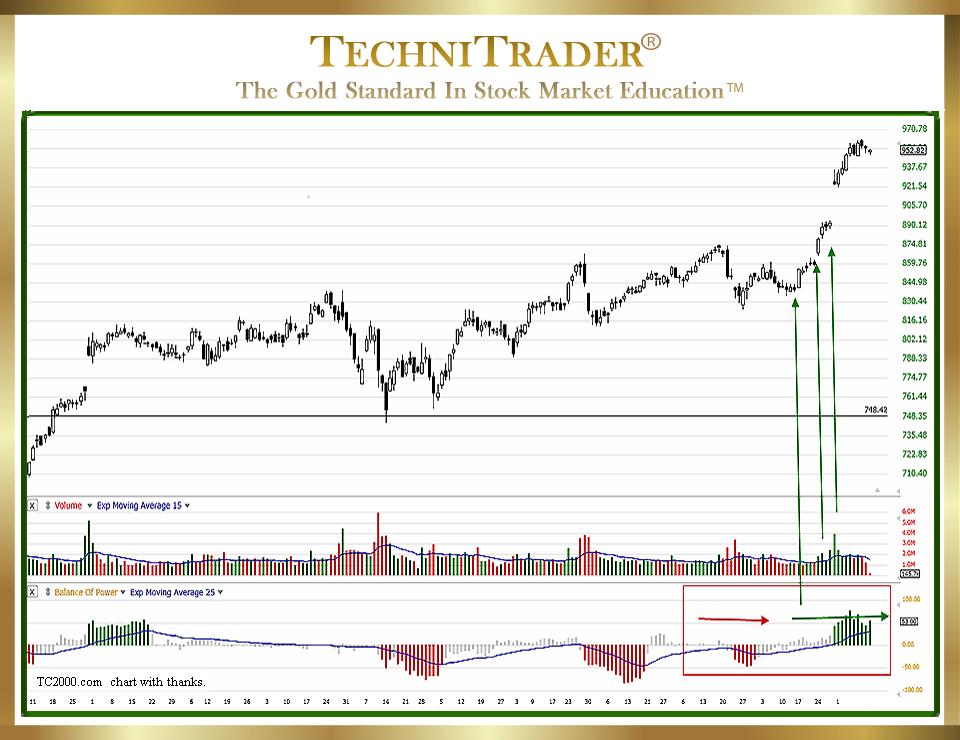

The chart above is a fine example of a pre-gap Balance of Power pattern. During the past two quarters, the Balance of Power indicator has shown some Portfolio and Trust adjustment patterns. High Frequency Traders have triggered to the downside, but they failed to drive price down. Smaller Funds were selling on the presumption of the HFT stock volume surge indicating a downside pressure.

The stock held and maintained with intermittent Gray Bars on the upside of the Balance of Power center line. Then, there was some minor accumulation again relating to Portfolio or Trust adjustments. Sometimes this stock example was in Dark Pool Quiet Rotation™, and there was also some additional Dark Pool Quiet Accumulation. The Red Bars shortened and ended in Balance of Power, just ahead of the earnings season.

News filters to the Giant Mutual and Pension Funds weeks ahead of what is presented to the general investing public. A Shift of Sentiment formed on Balance of Power. They were expecting a positive to surprise earnings report. The stock moved up with Professional Trader runs in a pre-earnings run with stronger stock volume and gray Balance of Power bars. Then, on the earnings report day, it gapped for a very tidy profit for those who bought into the Shift of Sentiment revealed by the Balance of Power indicator.

Summary

Learning to use Balance of Power requires an understanding of what each of the distinctly different Balance of Power patterns mean for our fully automated Stock Market where the majority of transactions are OFF the exchanges and hidden from view from those using Exchanges and Retail Brokers.

Balance of Power is one of the most important indicators to learn to use as it reveals buying or selling patterns of the larger institutions who are creating a huge liquidity draw while holding price in a controlled Dark Pool Buy Zone™.

Once news gets out in the professional side, the stock either runs in a huge run up in a single day OR gaps.

LEARN MORE at TechniTrader.Courses

If you have not yet begun to trade or invest, go to Introduction: Learn How to Trade Stocks – Free Video Lesson to get started.

Learn the steps to trade like a pro with this introductory mini course. You will learn what it takes to create a Professional Trading Plan that can help you achieve your trading goals: How to Create a Professional Trading Plan

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a TC2000 chart, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.