Wilder’s Relative Strength Index (RSI) Indicator vs. Stochastic

RSI Indicator Exposes Bottoming Stock Formation Strength Prior to Gaps

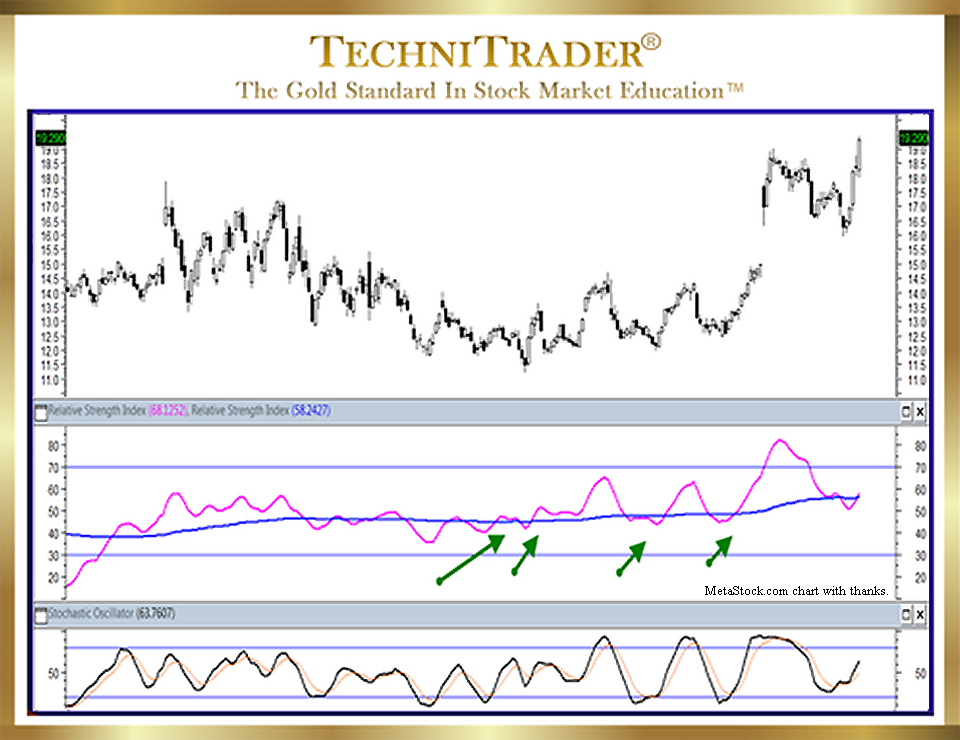

Wilder’s Relative Strength Index (RSI) has added analysis depth when using the center line oscillation feature. Instead of looking at merely Overbought/Oversold patterns of highs and lows, when Wilder’s Relative Strength Index indicator starts to waver around its center line, it exposes the bottoming pattern of the stock before it gaps up. Wilder’s Relative Strength Index is highly adaptable and easily modified. Below in the middle chart window is an example of how I set up this indicator for my TechniTrader Students.

LEARN MORE at TechniTrader.Courses

By comparison, the Stochastic indicator in the bottom chart window, as it is traditionally used strictly for Overbought/Oversold signals, is not exposing the bottoming action underway in the chart example. The oscillation actually causes whipsaw risks during this bottoming phase.

Using Wilder’s Relative Strength Index RSI indicator to expose the strength of the bottom via a center line that floats with price direction tells you far more about the strength of the sideways candlestick pattern and the decided upside direction, even though price is still sideways.

In addition, Wilder’s Relative Strength Index is a very different formula compared to the Stochastic indicator. Wilder wrote it to expose whether the current price was stronger or weaker than “X period” or number of days ago. Therefore, what you are looking at is a Relative Strength relationship between the current price and “x number of periods” aka days ago.

Wilder’s Relative Strength Index RSI indicator can and does expose strengthening price action to the upside or downside in a sideways candlestick pattern. This is a huge benefit for Retail Traders because the markets move sideways about 60% of the time.

LEARN MORE at TechniTrader.Courses

The Stochastic oscillator indicator is the most popular of all of the Price Oscillators available for stock chart analysis. Stock Indicators should be set up for your own personal Trading Style and trading parameters.

Being as specialized and proprietary as you can possibly be with your own unique set of trading indicators is a huge plus and gives you a decided edge against the Professional Traders in the Stock Market.

Using an indicator that is overly popular can be detrimental to your success as a trader. It can be hard to switch to a lesser-known indicator because most traders want to be part of the crowd. But being part of the retail crowd means you are constantly at higher risk of whipsaw trades, as “Cluster Orders” are constantly being tracked by the High Frequency Traders (HFTs).

Summary

The Stochastic indicator is great for exposing the Overbought/Oversold aspects of a sideways candlestick pattern. However, what is even more important is to be able to anticipate what direction the stock will move and how fast it will move out of a sideways candlestick pattern.

Wilder’s Relative Strength Index RSI indicator is superior in revealing strengthening price action, which in turn exposes momentum prior to gaps and fast runs. Use Wilder’s Relative Strength Index as the Stock Market begins to bottom. It is a very underrated indicator that Retail Traders can use to see momentum building prior to huge price gains.

LEARN MORE at TechniTrader.Courses

If you have not yet begun to trade or invest, go to Introduction: Learn How to Trade Stocks – Free Video Lesson to get started.

Learn the steps to trade like a pro with this introductory mini course. You will learn what it takes to create a Professional Trading Plan that can help you achieve your trading goals: How to Create a Professional Trading Plan

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a MetaStock chart, courtesy of Innovative Market Analysis, LLC dba MetaStock

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.