Why Trade Small Cap Stocks?

Trade with the Professional Traders for Higher Point Gain Potential

Many Retail Technical Traders are still unaware of a gold mine of trading opportunities that can yield higher profits due to wider spreads. The Securities and Exchange Commission (SEC) started a test pilot program for small cap stocks a couple of years ago to widen the spread to a minimum of 5 cents. The goal was to provide more liquidity from Professional Traders who require a wider spread to reach their point gain profit goals.

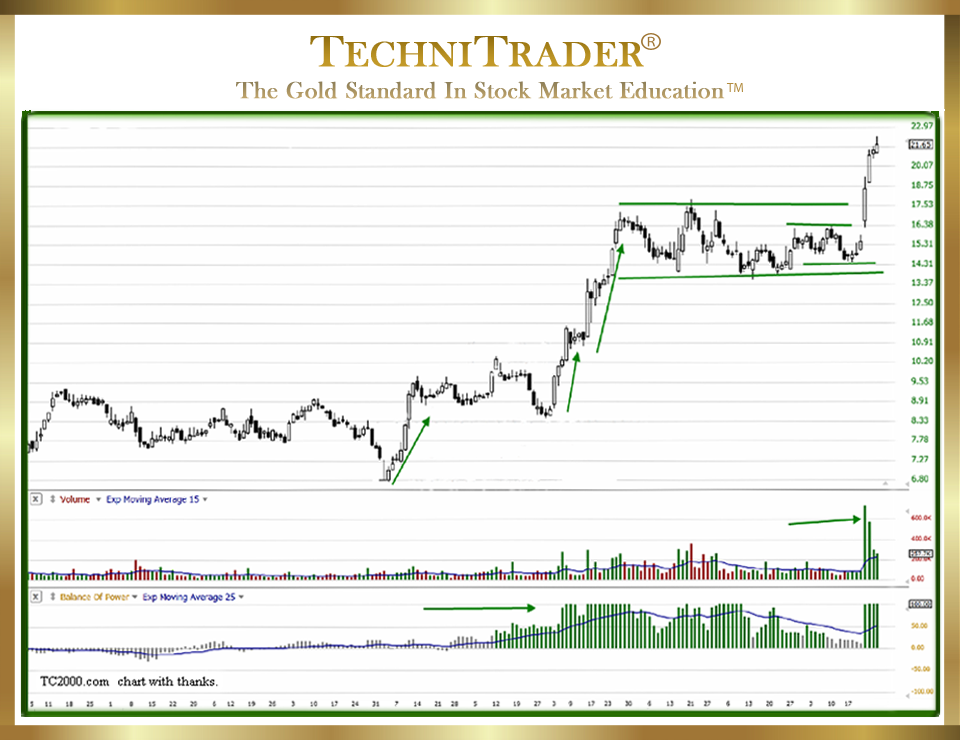

The chart below is an example of a small cap stock that is doing significantly better under the new ruling for wider spreads. The stock has moved up steadily, and each run has the telltale footprint of active Professional Traders trading short-term.

LEARN MORE at TechniTrader.com

The last run formed after a compression pattern that resulted in a High Frequency Traders (HFTs) initiated run that netted a nice profit for Retail Swing Traders as well.

TC2000.com Users also benefit by having Balance of Power, which reveals the large-lot trading activity before the HFT triggers cause the runs upward. In this chart, heavy concentrations of Professional Traders and Smaller Funds provide an easy-to-identify compression-style entry for a quick swing trade of 5+ points of profit in 4 days.

The SEC pilot program was an enormous success, and in late 2016, the test became a standard rule for the spreads on small cap stocks. However, many Retail Traders only trade large cap stocks because they think small caps are illiquid or that they do not move as much as a large cap.

LEARN MORE at TechniTrader.com

Small Cap Stocks under the SEC’s 5-cent spread ruling have become extremely popular with not only Professional Traders but also Dark Pools and High Frequency Traders. With more and more professional Stock Market Participant Groups trading small cap stocks, liquidity is no longer the issue it once was and more of these stocks are enjoying excellent Swing Trading-Style runs.

Small Cap stock trading is becoming more and more popular with the wider spread that provides higher point gain potential for Swing Traders, far more than most large cap big blue-chip stocks.

Smaller Caps are popular with Professional Traders, and their consistent technical patterns are easy to follow and trade with to ride the momentum wave their larger-lot trading initiates.

Professional Traders’ footprints are easily identified using Balance of Power (BOP), Time Segmented Volume (TSV), and other indicators from TC2000.com.

Summary

Instead of limiting your trading to just large cap stocks, consider learning how to trade small caps for higher point gain potential per trade with the ease of trading with the best Technical Traders in the market, the Professional Traders.

TC2000.com and TechniTrader have been partners for many years to bring Retail Traders the best software coupled with the Gold Standard in Stock Market Education™.

LEARN MORE at TechniTrader.com

If you have not yet begun to trade or invest, go to Introduction: Learn How to Trade Stocks – Free Video Lesson to get started.

Learn the steps to trade like a pro with this introductory mini course. You will learn what it takes to create a Professional Trading Plan that can help you achieve your trading goals: How to Create a Professional Trading Plan

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a TC2000 chart, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.