Why Use Bollinger Bands® %B for Swing Trade Entries?

To Customize Trading Style, Preferred Entry Signal, & Lower Entry Risk

Bollinger Bands are often used on the price chart itself, and they can be used on indicators as well. However, there are other indicators written by John Bollinger that give Swing and Day Traders an easier way to not only find strong momentum runs, but to also determine strength and run direction.

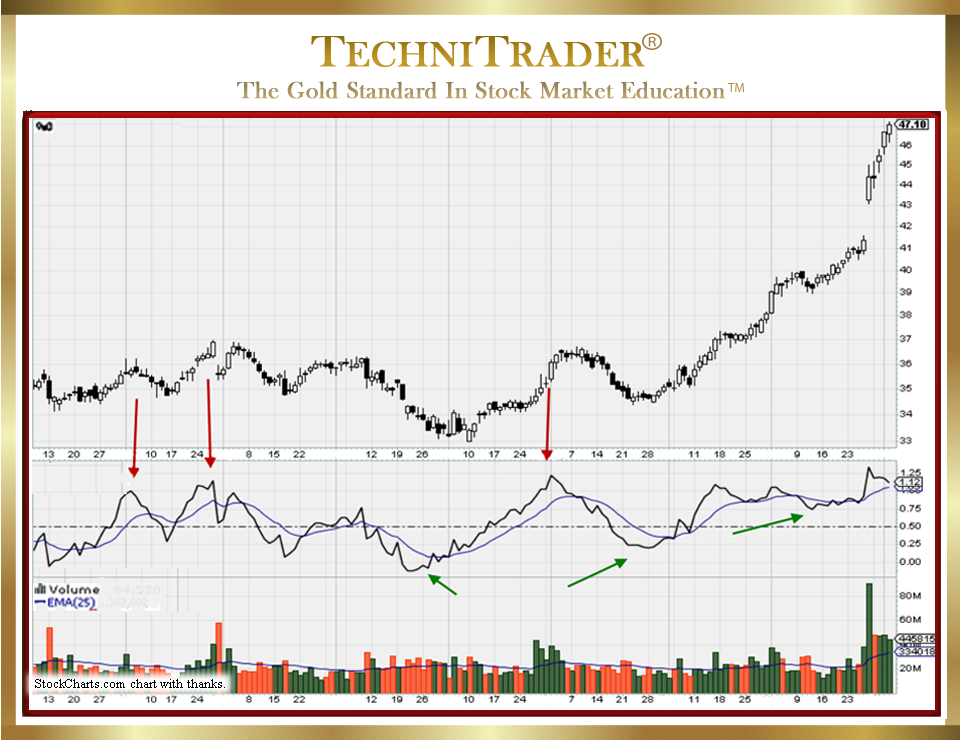

The chart example below shows the Peaks of %B that warn of profit taking on the short-term or daily trend, which is a reliable exit indicator signal. The chart also shows an extreme low indicating that the move down has ended and that the stock is going to head up after the consolidation.

LEARN MORE at TechniTrader.com

Even while price is compressing into the consolidation pattern on the chart, the %B clearly shows an upside energy building. The next higher low on %B indicates that more energy is building within the price action, and it precedes a strong momentum run that finally gaps.

By incorporating %B with your favorite Subordinate Indicator, you can customize your trading analysis for Swing or Day Trading and speed up your stock pick analysis process. %B is most reliable preceding momentum runs and is ideal for Bottoming Formation swing breakouts and strong runs. It is also very useful for Topping Formations before the stock breaks to the downside.

%B is one of the best indicators written by John Bollinger. If you are a fan of Bollinger Bands, you should add %B to your analysis, as it provides more information to guide you in your stock pick selections for Swing and Day Trading.

Using stock Volume and Quantity Indicators as well as Bollinger Bands is recommended, as all Bollinger Bands Indicators are price and time only. Including stock Volume, stock Volume Oscillators, Flow of Funds, or other Quantity-based Indicators will give you a complete set of data to analyze all aspects of the near-term price and stock volume action.

LEARN MORE at TechniTrader.com

Bollinger Bands %B is rarely used by Retail Traders, but it is a favorite among many Professional Traders. This Line Indicator can be set at various period settings allowing for customization to your Trading Style, your preferred entry signal, and to lower risk at entry of whipsaw action.

By adding a Subordinate Indicator to the %B, you are able to use the positive divergence for uptrend runs and the negative divergence for downtrend runs. This gives you a precise confirmation of entry for higher Swing Trading profits.

In addition, %B has several other patterns it forms warning of extreme price action before a retracement and the short-term bottoming pattern of Bollinger Bands B5 for reversals and rebounds after a minor short-term correction. By using %B, you are able to enter sooner for more points gained per trade.

Summary

Dark Pools do not disturb price while they are accumulating. Therefore, Quantity Indicators combined with %B give you a complete set of data to study, which will improve your results, reduce risk and whipsaw trades, and generate higher profits for Swing or Day Trades.

LEARN MORE at TechniTrader.com

If you have not yet begun to trade or invest, go to Introduction: Learn How to Trade Stocks – Free Video Lesson to get started.

Learn the steps to trade like a pro with this introductory mini course. You will learn what it takes to create a Professional Trading Plan that can help you achieve your trading goals: How to Create a Professional Trading Plan

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a StockCharts chart, courtesy of StockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2026 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.