How to Use a Complete Data Set for Stock Analysis

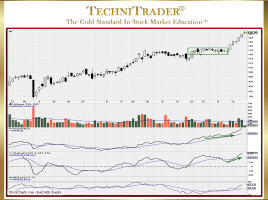

Include a Volume Indicator for Stock Picks In the early days of Technical Analysis, all of the data from the Stock Market was not readily available in a format that could be hand-drawn on a chart. The earliest chartists had to create their charts using either Point and Figure, Line, …