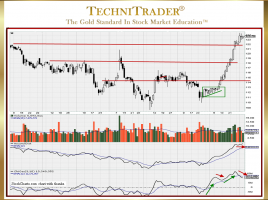

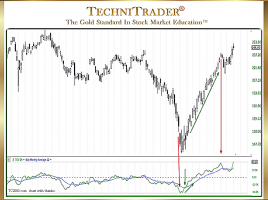

How to Interpret Time Segmented Volume Indicator for Entries and Exits

Contrarian Patterns Lead Price for Higher Profits The TC2000 Leading Indicator “Time Segmented Volume” (TSV) is unique in its formulation as a stock Volume Oscillator. Although there are a couple of other stock Volume Oscillators in the TC2000 Indicator list, Time Segmented Volume is far superior due to the unusual …